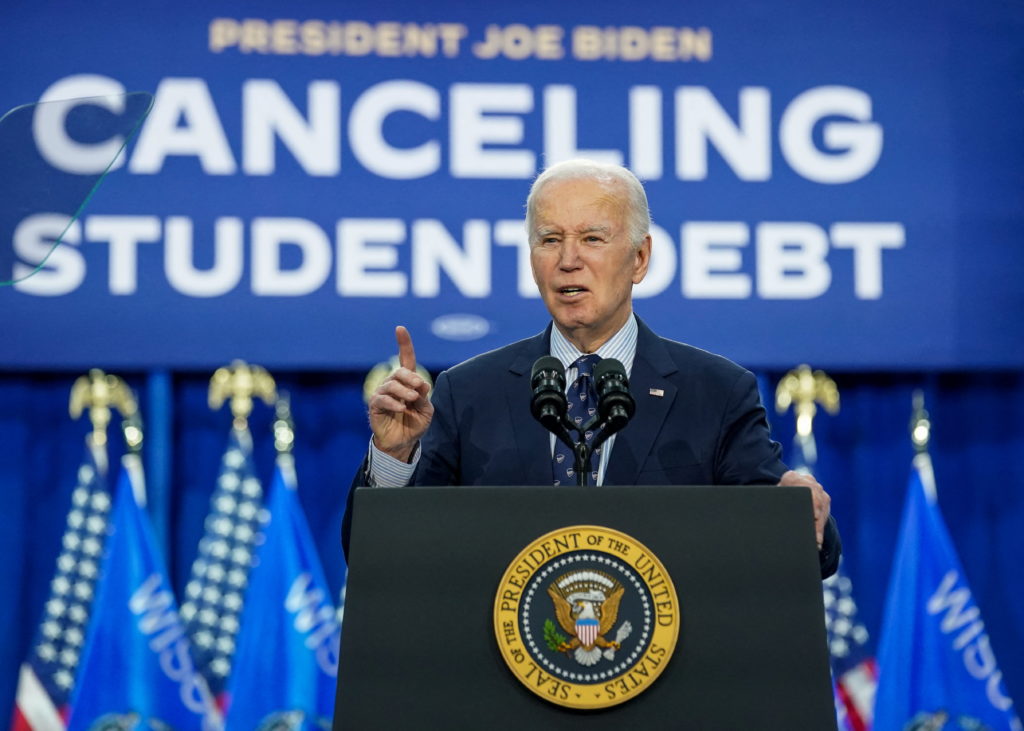

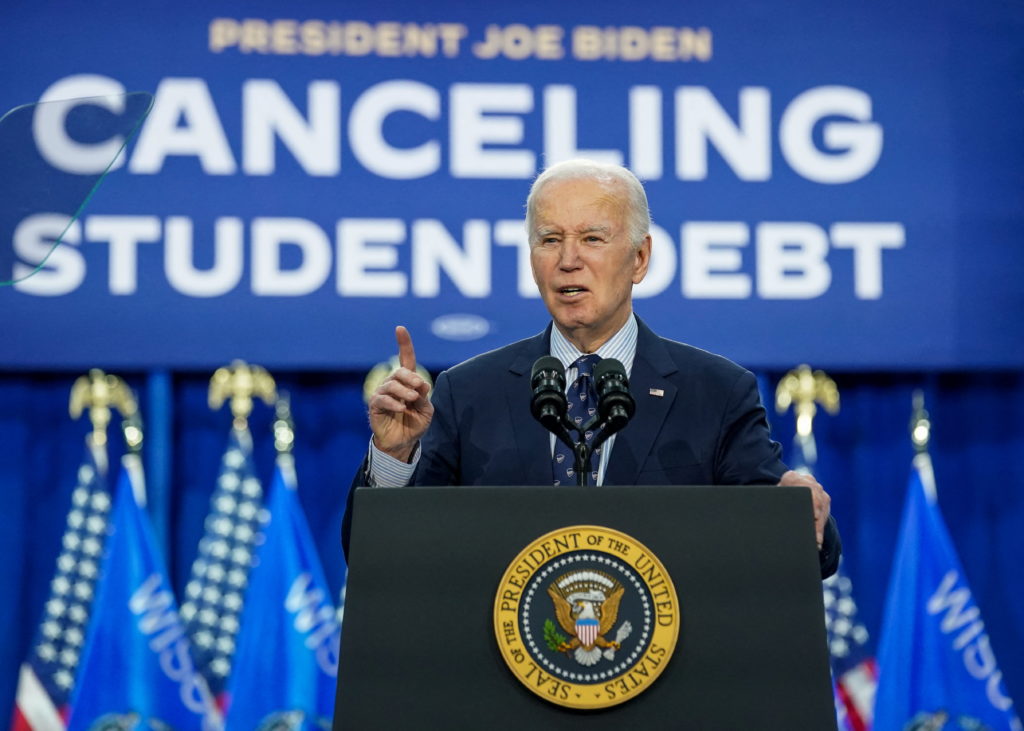

Canceling Student Loans: Biden’s Latest Move

In a move that could have far-reaching implications for the millions of Americans struggling with student loan debt, President Joe Biden is considering canceling federal student loans. The proposal has sparked both excitement and concern among students, parents, and educators alike. But what does it mean for your financial future? Are you tired of feeling like your student loans are holding you back from achieving your goals?

As the cost of higher education continues to rise, many graduates are left with crippling debt that can take years or even decades to pay off. The burden is not just financial – it can also take a toll on mental and emotional well-being. If President Biden’s proposal becomes a reality, could you be among those who benefit from this groundbreaking policy change?

In this article, we’ll delve into the details of Biden’s plan to cancel student loans and explore what it means for your financial future.

Canceling Student Loans: Biden’s Latest Move

In a move that could have far-reaching implications for the millions of Americans struggling with student loan debt, President Joe Biden is considering canceling federal student loans. The proposal has sparked both excitement and concern among students, parents, and educators alike.

According to the National Association of Student Financial Aid Administrators (NASFAA), over 45 million Americans have outstanding student loan debt, amounting to more than $1.7 trillion [1]. The cost of higher education continues to rise, making it increasingly difficult for graduates to pay off their loans.

A report by the Federal Reserve Bank of New York found that student loan debt has led to a decline in home ownership and delayed life milestones such as getting married and having children [2]. The burden is not just financial – it can also take a toll on mental and emotional well-being.

If President Biden’s proposal becomes a reality, could you be among those who benefit from this groundbreaking policy change? As the plan takes shape, we’ll continue to monitor developments and provide updates on how it may impact your financial future.

Take Control of Your Student Loans Today!

Canceling student loans can be a huge relief, but it’s not the only solution. Explore your debt options and find the best fit for you.

💬 Start Free ChatFAQs: Canceling Student Loans: Biden’s Latest Move

-

Q: What are the current rules for canceling student loans?

A: Under the existing rules, federal student loan borrowers can qualify for forgiveness programs such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. Additionally, some private lenders offer their own forgiveness programs. However, the Biden administration’s proposal aims to expand and simplify these programs.

-

Q: How does the Biden administration’s proposal for canceling student loans work?

A: The proposal would forgive up to $10,000 in federal student loan debt per borrower. It would also expand eligibility for PSLF and create a new program to forgive debt for borrowers who are struggling to make payments due to economic hardship. Additionally, the proposal aims to cap monthly payments at 5% of a borrower’s income.

-

Q: Who would be eligible for loan forgiveness under the Biden administration’s proposal?

A: The proposal would apply to federal student loan borrowers who are making progress towards debt repayment or have been in public service careers. Borrowers who are currently in default on their loans would also be eligible for forgiveness.

-

Q: Would the Biden administration’s proposal affect private student loans?

A: No, the proposal only applies to federal student loans. Private lenders would not be affected by this plan.

-

Q: How would loan forgiveness work for borrowers who are currently in default on their loans?

A: Borrowers who are currently in default on their loans would need to make a payment plan and demonstrate progress towards debt repayment before being eligible for forgiveness. The proposal aims to provide more flexible repayment options for borrowers who are struggling.

-

Q: What are the potential benefits of canceling student loans?

A: Canceling student loans could have numerous benefits, including increased economic activity, reduced financial stress, and improved overall well-being. It could also help address issues such as income inequality and access to higher education.

-

Q: What are the potential drawbacks of canceling student loans?

A: Some critics argue that forgiving student loans would disproportionately benefit those who have already accumulated significant debt, rather than addressing the root causes of rising tuition costs and student loan burdens. Others worry about the potential impact on private lenders and the overall financial system.

In conclusion, canceling student loans is a significant policy move that could have far-reaching implications for millions of Americans struggling with debt. President Joe Biden’s proposal aims to simplify and expand forgiveness programs, providing relief to borrowers who are making progress towards debt repayment or have been in public service careers.

While the potential benefits of canceling student loans include increased economic activity, reduced financial stress, and improved overall well-being, some critics argue that it would disproportionately benefit those who have already accumulated significant debt, rather than addressing the root causes of rising tuition costs and student loan burdens.

As the plan takes shape, it’s essential to continue monitoring developments and exploring how it may impact your financial future. Whether you’re a current or former student struggling with debt or an educator seeking ways to support students’ financial well-being, understanding the implications of canceling student loans is crucial for making informed decisions.

Stay tuned for updates on this groundbreaking policy move and its potential effects on your financial future.

Tackling Student Loan Debt: A Guide to Understanding Your 2017 Tax Bill: Are you struggling to make ends meet while dealing with student loan payments? Learn how to navigate your tax bill and find relief from the burden of high-interest loans.

Say Goodbye to Financial Stress: Same-Day Direct Tribal Payday Loans for Urgent Needs: Need cash fast? Discover the convenience of same-day direct tribal payday loans, designed to provide quick financial relief when you need it most.

Get Instant Access to Cash: Same-Day Deposit Payday Loans with Direct Lenders and No Credit Check: Are you tired of waiting for loan approvals? Get instant access to cash with same-day deposit payday loans from direct lenders, no credit check required. Apply now and receive your funds quickly!