Deducting Student Loan Interest: A Lifeline for Struggling Students

If you’re one of the millions of students saddled with student loan debt, you’re likely no stranger to financial stress. The weight of monthly payments can be overwhelming, making it difficult to make ends meet and achieve long-term financial stability.

However, there is a silver lining in this cloud: deducting student loan interest on your taxes! As of 2017, the Tax Cuts and Jobs Act (TCJA) has introduced new rules and limitations for claiming this valuable deduction. But before we dive into the details, let’s ask the question that’s keeping you up at night:

Are there still ways to deduct student loan interest in 2017?

Deducting Student Loan Interest: A Lifeline for Struggling Students

If you’re one of the millions of students saddled with student loan debt, you’re likely no stranger to financial stress. The weight of monthly payments can be overwhelming, making it difficult to make ends meet and achieve long-term financial stability.

However, there is a silver lining in this cloud: deducting student loan interest on your taxes! As of 2017, the Tax Cuts and Jobs Act (TCJA) has introduced new rules and limitations for claiming this valuable deduction. But before we dive into the details, let’s ask the question that’s keeping you up at night:

Are there still ways to deduct student loan interest in 2017?

The answer is yes! According to the IRS, taxpayers who are repaying student loans can claim a deduction of up to $2,500 for qualified education loan interest paid during the tax year. This can be especially helpful for those struggling with high-interest debt or trying to pay off their loans quickly.

To qualify for this deduction, your student loan must have been used solely to cover higher education expenses (including tuition, fees, and room and board) at an eligible educational institution. You’ll also need to meet certain income limits: single filers with modified adjusted gross income (MAGI) of $65,000 or less, and joint filers with MAGI of $130,000 or less can claim the full deduction.

It’s worth noting that while the TCJA has introduced some changes, the American Taxpayer Relief Act of 2012 had already eliminated the phase-out for high-income earners. This means that even those earning above the income limits can still deduct a portion of their student loan interest.

For more information on qualifying education expenses and eligible institutions, visit the IRS website.Now that you know how to deduct student loan interest in 2017, take control of your financial future by making strategic payments and exploring repayment options. Remember, every little bit counts – and those extra dollars can add up over time!

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatDeducting Student Loan Interest 2017 FAQs

-

Q: What is the student loan interest deduction?

A: The student loan interest deduction is a tax benefit that allows you to deduct up to $2,500 of the interest you paid on your student loans from your taxable income. This can help reduce your taxes and increase your take-home pay.

-

Q: Who qualifies for the student loan interest deduction?

A: You qualify for the student loan interest deduction if you are repaying a qualified education loan, which includes most federal and private student loans. To be eligible, your modified adjusted gross income (MAGI) must be less than $60,000 ($120,000 for married couples filing jointly). If your MAGI is higher than these amounts, the deduction is gradually phased out.

-

Q: What types of student loans qualify for the interest deduction?

A: The following types of student loans typically qualify for the interest deduction:

- Federal Direct Loans (Subsidized and Unsubsidized)

- Federal Family Education Loans (FFELs)

- Private education loans from banks, credit unions, or other lenders

-

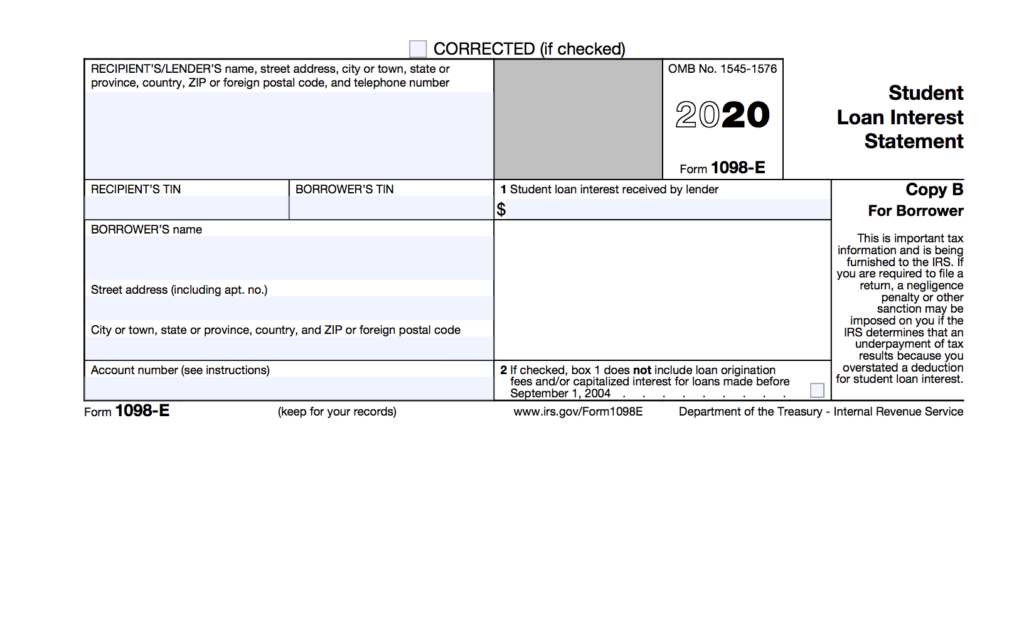

Q: How do I report the student loan interest deduction on my tax return?

A: You can claim the student loan interest deduction on Form 1040, Line 33. You’ll need to complete Schedule 1 (Form 1040) and enter the deduction amount from line 17 of that form.

-

Q: Are there any limitations or restrictions on the student loan interest deduction?

A: Yes, there are some limitations and restrictions to be aware of:

- You can only deduct up to $2,500 in interest per year.

- The deduction is gradually phased out if your MAGI exceeds $60,000 ($120,000 for married couples filing jointly).

- You must have paid the interest yourself; you cannot deduct interest paid by someone else (such as a parent or employer).

Now that you know how to deduct student loan interest in 2017, take control of your financial future by making strategic payments and exploring repayment options. Remember, every little bit counts – and those extra dollars can add up over time!

Same Day Payday Loans Online: Instant Cash Relief: Need emergency funds? Same day payday loans online provide instant cash relief with no hassle or lengthy application processes. Get approved quickly and access the funds you need to cover unexpected expenses.

Same Day Payday Loans: Quick Access to Financial Assistance: Struggling to make ends meet? Same day payday loans offer quick access to financial assistance, allowing you to cover urgent expenses without breaking the bank. Apply now and get back on track!

Same Day Funding: California Payday Loans – No Credit Check, Direct Lender: In need of emergency funds in California? Same day funding payday loans offer no credit check and a direct lender, ensuring you get the cash you need quickly. Apply now and get back on your feet!