Does Bankruptcy Discharge Student Loans?

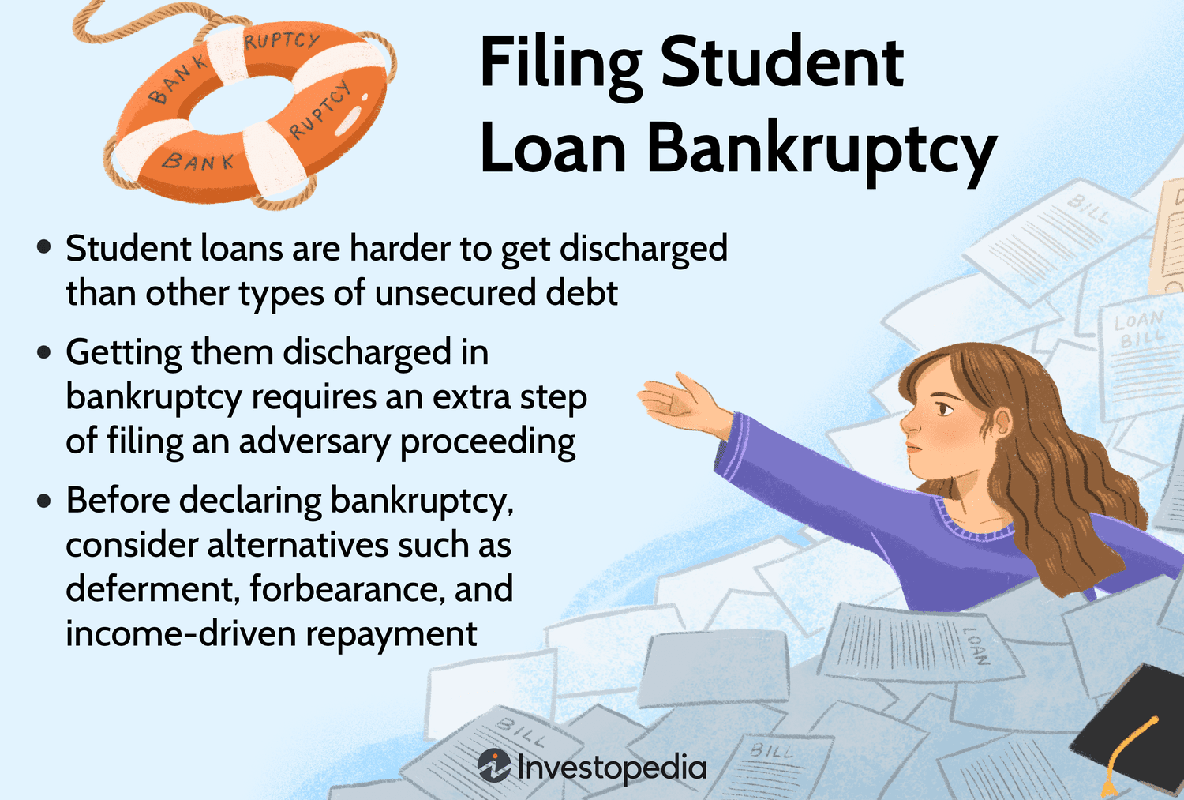

The weight of student loan debt can be crushing, making it difficult for individuals to make ends meet, let alone enjoy the fruits of their labor. With millions of Americans struggling with outstanding education loans, a common question arises: does bankruptcy discharge student loans? The answer is not straightforward.

Struggling to Repay Student Loans?

If you’re among the many individuals facing financial hardship due to overwhelming student loan debt, you’re not alone. With the rising cost of higher education and stagnant income growth, it’s no wonder that many students are finding themselves in a precarious situation.

In this article, we’ll delve into the complexities surrounding bankruptcy and its potential impact on student loans. We’ll explore the nuances of federal and private loan debt, as well as the options available for those seeking relief from their financial burden.

Does Bankruptcy Discharge Student Loans?

The weight of student loan debt can be crushing, making it difficult for individuals to make ends meet, let alone enjoy the fruits of their labor. With millions of Americans struggling with outstanding education loans, a common question arises: does bankruptcy discharge student loans? The answer is not straightforward.

Struggling to Repay Student Loans?

If you’re among the many individuals facing financial hardship due to overwhelming student loan debt, you’re not alone. With the rising cost of higher education and stagnant income growth, it’s no wonder that many students are finding themselves in a precarious situation.

The federal government has implemented policies aimed at making student loans more manageable. For instance, income-driven repayment plans allow borrowers to cap their monthly payments based on their income and family size. However, these plans do not eliminate the debt entirely.

Private student loans are a different story altogether. These loans are not guaranteed by the federal government, which means they can be discharged through bankruptcy. According to the Federal Reserve, private student loan debt is dischargeable in bankruptcy if it can be proven that repaying the debt would cause “undue hardship.” This burden of proof lies with the borrower, who must demonstrate that they have made a good-faith effort to repay the loan but are still unable to do so due to financial constraints.

It’s essential for borrowers to understand the implications of bankruptcy on their student loans. While private student loans may be dischargeable in certain circumstances, federal student loans are generally not discharged through bankruptcy. The National Student Loan Data System provides detailed information on federal student loan debt and repayment options.

Borrowers struggling with student loan debt should consult with a financial advisor or attorney to explore their options for repaying or discharging their loans. By understanding the complexities surrounding bankruptcy and student loans, individuals can take control of their financial situation and work towards a more stable financial future.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFAQ: Does Bankruptcy Discharge Student Loans?

-

Q: Can I discharge my student loans through bankruptcy?

A: No, student loans are generally not dischargeable in bankruptcy. The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) of 2005 made significant changes to the rules governing bankruptcy and student loans.

Conclusion

In conclusion, while student loan debt can be crushing, understanding the complexities surrounding bankruptcy and its potential impact on student loans is crucial for individuals seeking relief from their financial burden.

Borrowers struggling with private student loans may have options to discharge their debts through bankruptcy, but this process requires a demonstration of undue hardship. Federal student loans, however, are generally not dischargeable in bankruptcy.

It’s essential for borrowers to seek professional guidance from a financial advisor or attorney to explore their options for repaying or discharging their loans. By understanding the nuances surrounding bankruptcy and student loans, individuals can take control of their financial situation and work towards a more stable future.

Same day online payday loan quick cash solution: Need a fast and convenient way to access emergency funds? This article explores the benefits of same-day online payday loans, including no credit check requirements and instant funding. Discover how you can get your hands on quick cash in just one day!

Same day funding california payday loans – no credit check direct lender: Are you a California resident in need of fast cash? This article highlights the advantages of same-day funding payday loans, including direct lender options and no credit check requirements. Find out how you can access emergency funds quickly and easily!

Get same day payday loan online in texas: In need of a quick cash solution in Texas? This article provides an overview of same-day payday loans available online, including instant funding and no credit check requirements. Learn how you can get access to emergency funds fast and conveniently!