Fake Payday Loan Collection Emails: A Growing Concern

You’ve probably heard the horror stories about fake payday loan collection emails – emails that claim to be from a legitimate lender or debt collector, but are actually just scammers trying to trick you out of your hard-earned cash. But how do these scammers manage to fool so many people? And what can you do to protect yourself?

A Growing Problem

Payday loans have become a popular option for people in need of quick cash, but unfortunately, this has also led to a rise in fake payday loan collection emails. These scammers are getting more and more sophisticated, making it harder to spot the difference between a real debt collector and a phony one.

So, if you’re receiving an email claiming that you owe money on a payday loan, how do you know whether it’s real or fake? And what should you do if you suspect that your email is part of this growing problem?

Fake Payday Loan Collection Emails: A Growing Concern

You’ve probably heard the horror stories about fake payday loan collection emails – emails that claim to be from a legitimate lender or debt collector, but are actually just scammers trying to trick you out of your hard-earned cash. But how do these scammers manage to fool so many people? And what can you do to protect yourself?

A Growing Problem

Payday loans have become a popular option for people in need of quick cash, but unfortunately, this has also led to a rise in fake payday loan collection emails. According to the Federal Trade Commission (FTC), these scams are increasing at an alarming rate.

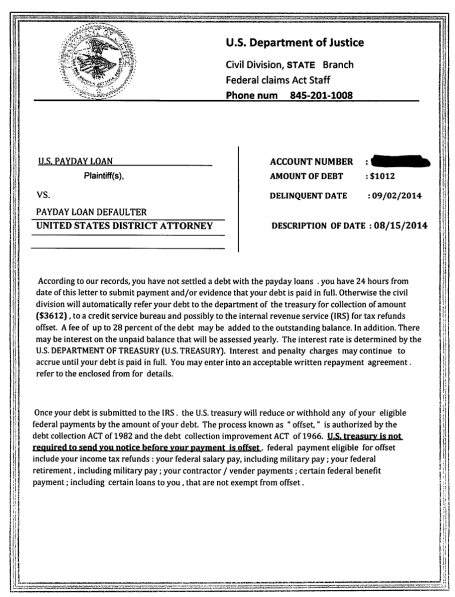

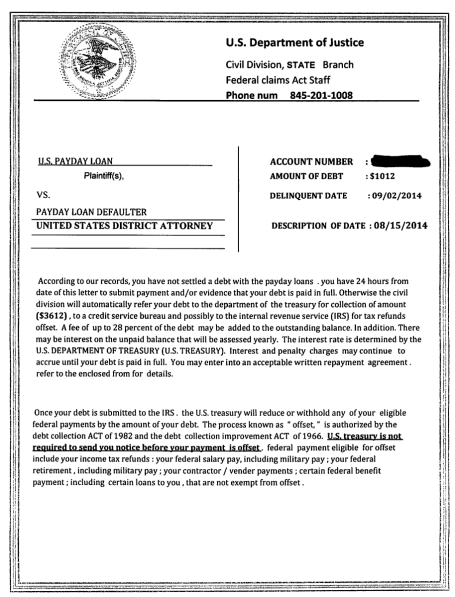

The scammers behind these fake emails are getting more and more sophisticated, making it harder to spot the difference between a real debt collector and a phony one. They may use convincing logos, realistic-looking email addresses, and even fake names to make their emails seem legitimate.

So, if you’re receiving an email claiming that you owe money on a payday loan, how do you know whether it’s real or fake? The first step is to verify the identity of the sender. Check the email address and look for any typos or inconsistencies. Also, be wary of emails that ask for personal information or payment.

If you’re unsure about the authenticity of an email, don’t hesitate to reach out to your lender or debt collector directly. They should be able to confirm whether the email is legitimate or not. Additionally, the FTC recommends reporting any suspicious emails to their complaint database.

🚀 Get Up to $1,500 in Minutes – No Credit Check!

Need Cash Urgently? Free Chat with a Loan Expert Now/p> Get Instant Approval – Chat Now!

Frequently Asked Questions about Fake Payday Loan Collection Emails

-

Q: What are fake payday loan collection emails?

A: Fake payday loan collection emails are fraudulent messages that appear to be from a legitimate payday lender or debt collector, but are actually scams designed to trick you into revealing sensitive information or paying a fee.

-

Q: Why do I keep receiving these fake collection emails?

A: Scammers often use phishing tactics to target individuals who have applied for payday loans in the past. They may also use publicly available information, such as social media profiles or online directories, to find potential victims.

-

Q: How can I identify a fake collection email?

A: Be cautious of emails that:

- Use generic greetings instead of addressing you by name

- Contain spelling and grammar errors

- Ask for personal or financial information, such as login credentials or bank account numbers

- Say your loan has been sold to a new company or that you owe more money than you originally borrowed

-

Q: What should I do if I receive a fake collection email?

A: If you suspect an email is fake:

- Do not respond or click on any links

- Report the email to the Federal Trade Commission (FTC) and your email provider’s abuse department

- Contact your state’s Attorney General office for guidance

Conclusion

In conclusion, fake payday loan collection emails are a growing concern that can have serious consequences for your financial well-being. It’s essential to be aware of these scams and take steps to protect yourself from falling victim.

To avoid being targeted by scammers, make sure to verify the identity of the sender and look out for any red flags such as spelling errors or generic greetings. If you’re unsure about the authenticity of an email, don’t hesitate to reach out to your lender or debt collector directly and report any suspicious emails to the Federal Trade Commission (FTC) and your email provider’s abuse department.

By staying informed and taking proactive steps to protect yourself, you can minimize the risk of falling prey to these scams and enjoy peace of mind knowing that your personal and financial information is safe.

Online Payday Loans Sacramento: Are you in a financial pinch and need quick access to cash in Sacramento? Our online payday loans in Sacramento can provide the help you need. With flexible repayment terms and competitive interest rates, our lenders are here to assist you.