Unlock Financial Flexibility: A Free Promissory Note Template for Personal Loan

In today’s fast-paced world, personal loans have become a common means of financing life’s unexpected expenses or big-ticket purchases. However, navigating the process of lending and borrowing can be overwhelming, especially when it comes to creating a binding agreement that ensures repayment.

Are you struggling to draft a promissory note for your personal loan? Do you want to avoid any potential legal disputes down the line?

Fret Not! We’ve Got You Covered

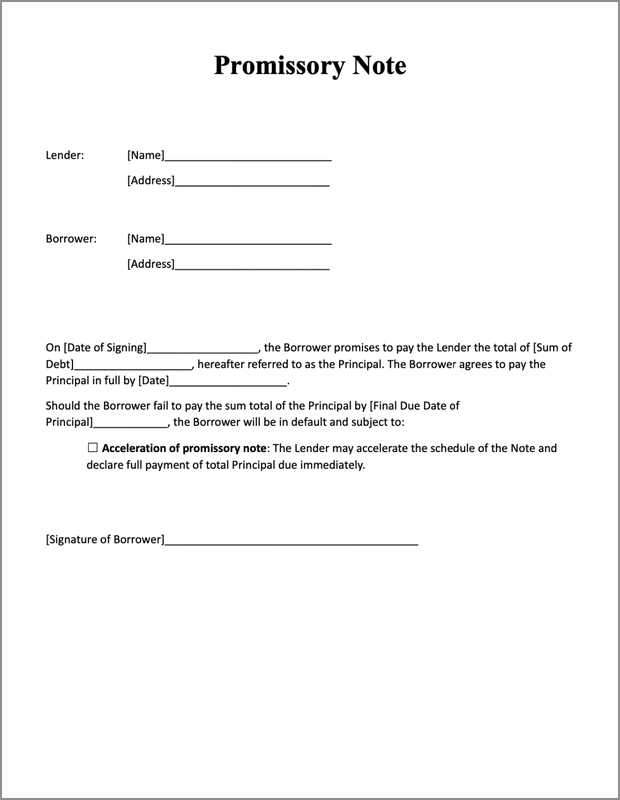

A well-crafted promissory note is essential for establishing a clear understanding between the borrower and lender. But, creating one from scratch can be time-consuming and may lead to costly mistakes. This is where our free promissory note template for personal loan comes in – a valuable tool that streamlines the process, ensuring your agreement is comprehensive, legally binding, and easy to understand.

In this article, we’ll dive into the world of promissory notes, explore their importance, and provide you with a downloadable template to simplify the lending process.

A Comprehensive Guide to Free Promissory Note Template for Personal Loan

A promissory note is a legal document that outlines the terms of a personal loan agreement between two parties: the borrower and the lender. When drafting such an agreement, it’s essential to consider the repayment schedule, interest rates, late payment fees, and any collateral involved. A well-crafted promissory note ensures a clear understanding of the borrower’s obligations and the lender’s rights.

According to Investopedia, a promissory note is a written promise to pay a debt, which can be secured or unsecured. Secured promissory notes involve collateral, while unsecured notes rely solely on the borrower’s creditworthiness.

In the context of personal loans, a promissory note serves as a binding agreement between individuals. This type of loan is often used to finance life’s unexpected expenses, such as medical bills or car repairs, or to make large purchases like a new appliance or furniture.

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions (FAQs)

Q: What is a promissory note?

A: A promissory note is a written agreement between two parties, outlining the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and any collateral or security provided.

Q: Why do I need a free promissory note template for personal loan?

A: A free promissory note template helps ensure that all parties involved in a personal loan understand the terms of the agreement. It provides a clear and concise outline of the repayment schedule, interest rates, and any other conditions. This can help prevent misunderstandings or disputes.

Q: Can I customize the free promissory note template for my specific needs?

A: Yes! Our free promissory note template is designed to be flexible and adaptable to your unique circumstances. You can modify the terms, interest rates, and repayment schedule to suit your specific needs.

Q: Is a promissory note necessary for every personal loan?

A: While not always required, a promissory note is highly recommended when lending or borrowing money from friends, family, or individuals. It helps establish clear boundaries and expectations, which can help maintain a positive relationship.

Q: Can I use the free promissory note template for commercial loans?

A: No. The free promissory note template is designed specifically for personal loans between individuals or small businesses. For commercial loans or large-scale transactions, it’s best to consult with a financial professional or attorney to ensure compliance with relevant laws and regulations.

Conclusion: Unlocking Financial Flexibility with a Free Promissory Note Template for Personal Loan

In conclusion, navigating the process of lending and borrowing can be overwhelming without a clear understanding of the terms involved. A well-crafted promissory note serves as a binding agreement between two parties, outlining the repayment schedule, interest rates, and any collateral or security provided.

By utilizing our free promissory note template for personal loan, you can ensure that all parties are on the same page, reducing the risk of misunderstandings or disputes. With its comprehensive outline and customizable features, this template is designed to simplify the lending process while providing a clear understanding of the borrower’s obligations and the lender’s rights.

When it comes to personal loans between individuals or small businesses, a promissory note can be an invaluable tool in establishing a positive relationship built on trust and mutual understanding. By taking the time to draft a comprehensive agreement, you can avoid costly mistakes and ensure that your financial needs are met in a responsible and legal manner.

We hope this guide has provided valuable insights into the importance of promissory notes and how our free template can help streamline the process. Whether you’re lending or borrowing money, it’s essential to have a clear understanding of the terms involved. With our template, you can take control of your financial situation and unlock the flexibility you need to achieve your goals.

Same day direct tribal payday loans quick cash solution for your urgent needs: Get instant access to same-day payday loans and say goodbye to financial stress! Discover how these quick cash solutions can help you cover unexpected expenses without the hassle of lengthy approval processes.

Same day cash online payday loan – get quick approval: Need cash fast? Same-day online payday loans are here to help! With a quick and easy application process, you can get the financial relief you need in no time. Learn more about how these loans can provide instant cash solutions for your urgent needs.

Same day payday loans online – instant cash relief: Facing a financial emergency? Same-day payday loans are the answer! With our online application process, you can get instant approval and access to the cash you need to cover unexpected expenses. Don’t let financial stress weigh you down – click here to learn more!