Free Promissory Note Template for Personal Loan to Family Member: Simplify Your Lending Experience

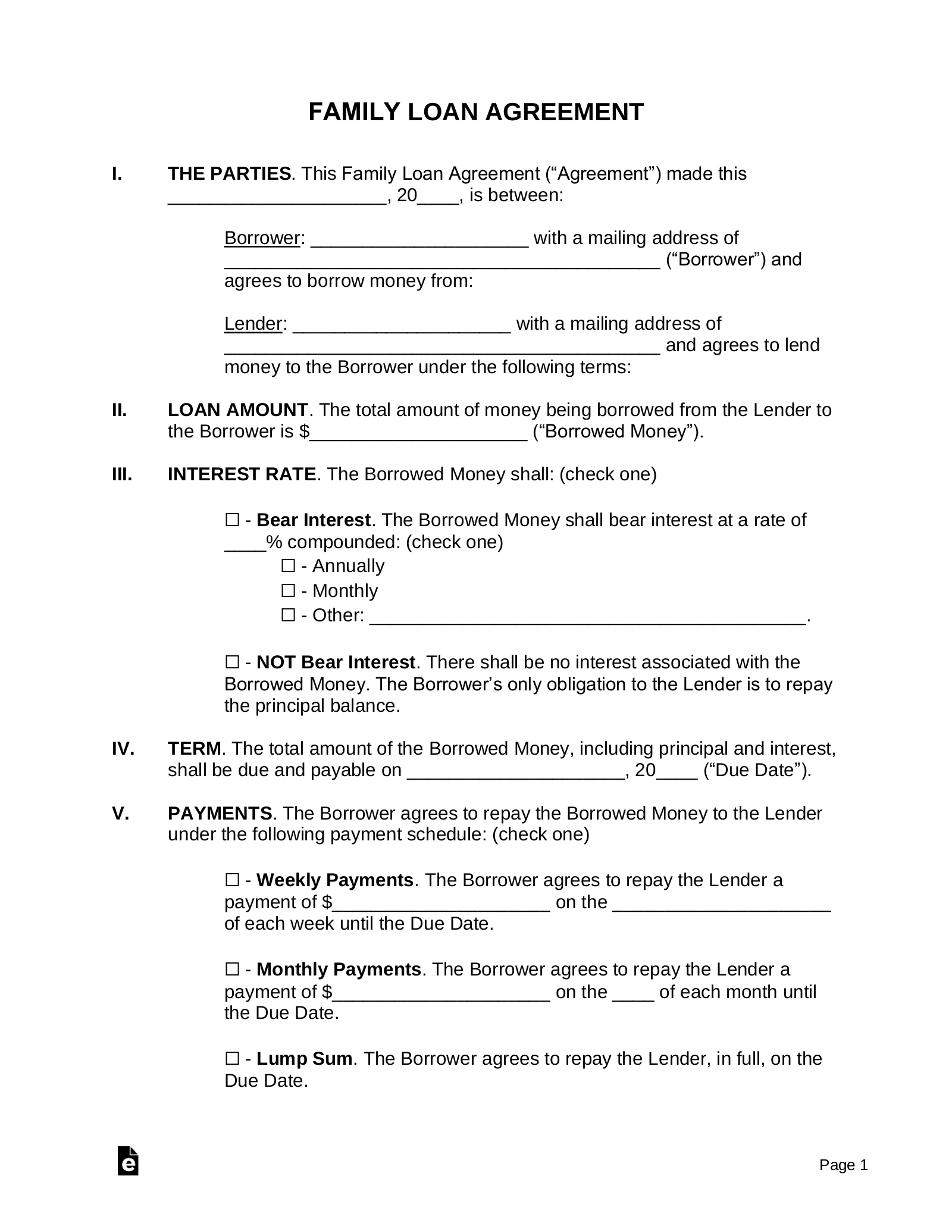

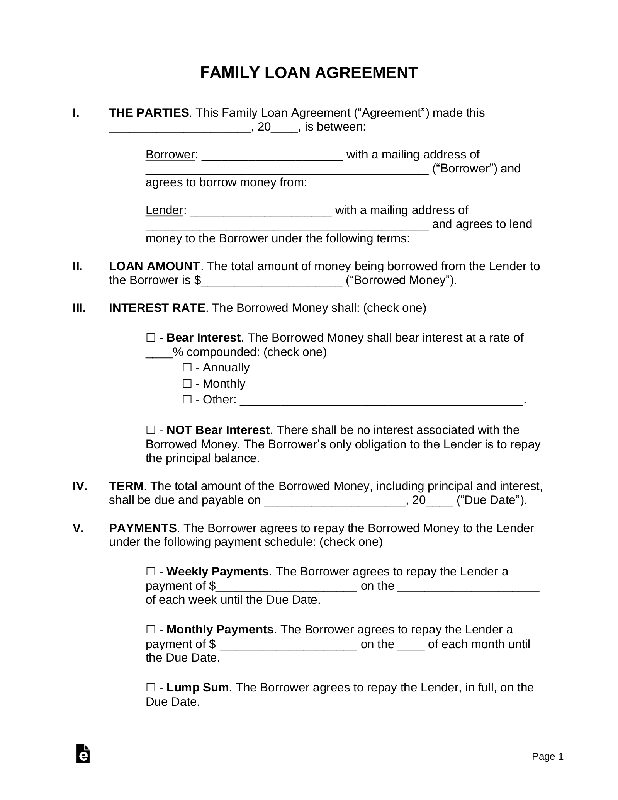

Are you considering lending money to a family member or friend? While it’s natural to want to help those we care about, it’s essential to establish a clear understanding of the loan terms to avoid any misunderstandings. A promissory note is a written agreement that outlines the borrower’s commitment to repay the loan, along with the interest rate, repayment schedule, and other crucial details.

Creating a personalized promissory note template can be a time-consuming and overwhelming task, especially if you’re not familiar with legal jargon. That’s why we’ve developed a free promissory note template for personal loans to family members, making it easier than ever to formalize your lending agreement.

Why Use a Promissory Note Template?

A well-structured promissory note ensures that both parties have a clear understanding of the loan terms, reducing the risk of disputes or misunderstandings. By using our free template, you can:

- Establish a clear repayment schedule

- Determine the interest rate and payment frequency

- Simplify the loan application process

- Protect your interests as the lender

In this article, we’ll guide you through the process of creating a personalized promissory note template for personal loans to family members. With our free template, you can rest assured that your lending agreement is secure and binding.

Free Promissory Note Template for Personal Loan to Family Member: Simplify Your Lending Experience

Are you considering lending money to a family member or friend? While it’s natural to want to help those we care about, it’s essential to establish a clear understanding of the loan terms to avoid any misunderstandings. A promissory note is a written agreement that outlines the borrower’s commitment to repay the loan, along with the interest rate, repayment schedule, and other crucial details.

Creating a personalized promissory note template can be a time-consuming and overwhelming task, especially if you’re not familiar with legal jargon. That’s why it’s recommended to seek guidance from a lawyer or financial advisor (1).

Why Use a Promissory Note Template?

A well-structured promissory note ensures that both parties have a clear understanding of the loan terms, reducing the risk of disputes or misunderstandings. By using our free template, you can:

- Establish a clear repayment schedule (2)

- Determine the interest rate and payment frequency

- Simplify the loan application process

- Protect your interests as the lender

A promissory note also provides a formal record of the loan, which can be useful for tax purposes or in case of default (3).

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions

-

Q: What is a promissory note for a personal loan to a family member?

A: A promissory note is a written agreement that outlines the terms of a personal loan between two individuals, typically a family member. It defines the borrower’s obligation to repay the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral used as security.

-

Q: Why is it important to have a written promissory note for a personal loan to a family member?

A: A written promissory note helps establish a clear understanding of the loan terms and protects both parties’ interests. It provides a formal record of the agreement, which can help resolve disputes or misunderstandings that may arise during the repayment period.

-

Q: Can I modify the free promissory note template for my specific situation?

A: Yes, you should customize the template to fit your unique circumstances. The template provides a starting point, but you may need to add or remove sections depending on your loan terms and local laws.

-

Q: Do I need legal advice to create a promissory note for a personal loan to a family member?

A: While it’s not necessary, having legal advice can be beneficial, especially if you’re unsure about the loan terms or have complex circumstances. A lawyer can help ensure that your agreement is enforceable and compliant with local laws.

-

Q: How do I ensure that my promissory note is legally binding?

A: To make the promissory note legally binding, both parties must sign it voluntarily, in exchange for consideration (such as a loan), and have legal capacity to enter into the agreement. You should also include any necessary witnesses or notarizations required by your jurisdiction.

Conclusion

In conclusion, creating a personalized promissory note template for personal loans to family members can simplify the lending experience and protect both parties’ interests. By using our free template, you can establish a clear repayment schedule, determine the interest rate and payment frequency, simplify the loan application process, and protect your interests as the lender.

A well-structured promissory note ensures that both parties have a clear understanding of the loan terms, reducing the risk of disputes or misunderstandings. With our free template, you can rest assured that your lending agreement is secure and binding.

Does accepting a student loan mean I’m taking it out: Learn about the ins and outs of student loans, from application to repayment. Whether you’re a student or just starting your financial journey, this article will help you navigate the complex world of education financing.

Same day guaranteed payday loans: Are you in need of fast cash? Same-day guaranteed payday loans might be the solution you’re looking for. Discover how these loans can provide a financial safety net and help you get back on your feet.

Guaranteed approval best bad credit payday loans: Bad credit holding you back from getting the loan you need? This article reveals the secrets to guaranteed approval for bad credit payday loans. Whether you’re facing financial emergencies or just need a little extra help, this information is essential.