Getting a Personal Loan with a 600 Credit Score: What You Need to Know

If you’re struggling to make ends meet or need some extra cash for an unexpected expense, getting a personal loan can be a viable solution. However, having a 600 credit score can make it challenging to secure the funds you need. You might wonder, “Can I get a personal loan with a 600 credit score?” The answer is yes, but it’s essential to understand what lenders are looking for and how to improve your chances of approval.

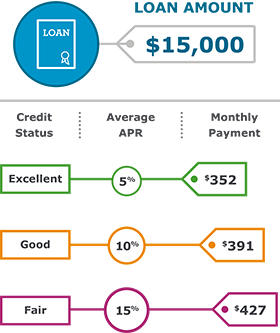

A credit score of 600 falls into the fair category, which means you’re not considered a high-risk borrower. Nevertheless, many lenders may view you as a moderate risk due to your lower credit score. This can result in higher interest rates or stricter loan terms. In this guide, we’ll explore what you need to know about getting a personal loan with a 600 credit score.

Getting a Personal Loan with a 600 Credit Score: What You Need to Know

If you’re struggling to make ends meet or need some extra cash for an unexpected expense, getting a personal loan can be a viable solution. However, having a 600 credit score can make it challenging to secure the funds you need. You might wonder, “Can I get a personal loan with a 600 credit score?” The answer is yes, but it’s essential to understand what lenders are looking for and how to improve your chances of approval.

A credit score of 600 falls into the fair category, which means you’re not considered a high-risk borrower. Nevertheless, many lenders may view you as a moderate risk due to your lower credit score. This can result in higher interest rates or stricter loan terms (like this article on Credit Karma explains).

To improve your chances of approval, you’ll want to focus on the following factors:

- Repayment history: Lenders will evaluate your payment history to determine whether you’re reliable in paying back loans. This includes on-time payments, missed payments, and accounts sent to collections.

- Credit utilization: Keep an eye on your credit utilization ratio, which is the amount of credit used compared to the total available. Aim for a utilization rate below 30% (as explained by MyFICO).

- Length of credit history: A longer credit history can positively impact your credit score. Consider keeping old accounts open to show lenders you’ve managed credit responsibly over time.

- Credit mix: Aim for a balanced mix of different credit types, such as installment loans, credit cards, and mortgages. This demonstrates your ability to manage various types of credit responsibly (as discussed by Experian).

By understanding these key factors and taking steps to improve your credit score, you can increase your chances of securing a personal loan with a 600 credit score. Remember that lenders may still offer higher interest rates or stricter terms due to your lower credit score.

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions

-

Q: What is a good credit score?

A: A good credit score depends on the specific scoring model used. For FICO scores, which are commonly used by lenders, a good credit score would be around 670 or higher.

-

Q: Can I get a personal loan with a 600 credit score?

A: Yes, it is possible to get a personal loan with a 600 credit score. However, you may face higher interest rates and stricter lending terms compared to someone with a higher credit score.

-

Q: What are the benefits of having a good credit score for personal loans?

A: Having a good credit score can provide several benefits when applying for personal loans, including lower interest rates, longer loan terms, and access to more lenders. It can also help you qualify for better loan offers and reduce your overall borrowing costs.

-

Q: Are there any specific personal loan options available for people with 600 credit scores?

A: Yes, there are several personal loan options available for people with 600 credit scores. These may include online lenders, peer-to-peer lending platforms, and credit unions that offer more lenient lending criteria.

-

Q: How can I improve my credit score before applying for a personal loan?

A: Improving your credit score before applying for a personal loan involves several steps, including paying your bills on time, reducing debt, and monitoring your credit report for errors. You can also consider requesting a credit limit increase or opening a new account to demonstrate responsible borrowing behavior.

Conclusion

In conclusion, getting a personal loan with a 600 credit score is possible, but it’s crucial to understand the lenders’ perspective and how to improve your chances of approval.

Focusing on your repayment history, credit utilization, length of credit history, and credit mix can help you secure a personal loan. Keep in mind that even with a good understanding of these factors, lenders may still offer higher interest rates or stricter terms due to your lower credit score.

By taking steps to improve your credit score, such as paying bills on time, reducing debt, and monitoring your credit report for errors, you can increase your chances of securing a personal loan with favorable terms. Remember that a good credit score can provide numerous benefits when applying for personal loans, including lower interest rates, longer loan terms, and access to more lenders.

Get the Best Rates on Student Loans: Whether you’re a student or a parent looking to help your child fund their education, getting the best rates on student loans can make all the difference. This article provides valuable insights and tips to help you navigate the complex world of student loans and secure the lowest interest rates possible.

Main Financial One Personal Loan Rates: Are you in need of a personal loan but unsure where to start? Main Financial One offers competitive rates and flexible repayment terms. This article breaks down their rates and helps you make an informed decision about your financial future.

FMFCU Personal Loan Rates: Your Guide: If you’re a credit union member looking for a personal loan, FMFCU has got you covered. This article provides an in-depth guide to their rates and repayment terms, helping you make the best choice for your financial situation.