Unlocking the Secrets of FAFSA Student Loans: A Guide for Students

Are you a student struggling to make ends meet while pursuing your higher education? Are you wondering how FAFSA student loans work and what options are available to help you fund your studies?

If so, you’re not alone. Financing a college education can be overwhelming, especially with the rising costs of tuition fees, room, and board. But don’t worry, we’ve got you covered! In this comprehensive guide, we’ll break down the basics of FAFSA student loans, helping you navigate the complex world of financial aid.

What You Need to Know About FAFSA Student Loans

In this guide, we’ll explore the ins and outs of FAFSA student loans, including:

- The different types of federal student loans available through FAFSA

- The application process and requirements for FAFSA loans

- How to manage your loan debt effectively

- Tips and strategies for avoiding common pitfalls and pitfalls in the financial aid process

Whether you’re a first-time college student or a returning adult learner, this guide is designed to provide you with the knowledge and tools needed to make informed decisions about your financial aid options. So, let’s dive in and explore how FAFSA student loans can help you achieve your academic goals.

How Do FAFSA Student Loans Work?

Financing a college education can be overwhelming, especially with the rising costs of tuition fees, room, and board. But understanding how FAFSA student loans work is crucial to making informed decisions about your financial aid options. In this guide, we’ll break down the basics of FAFSA student loans, helping you navigate the complex world of financial aid.

The Different Types of Federal Student Loans Available Through FAFSA

There are several types of federal student loans available through FAFSA, including:

- Direct Subsidized Loan: A loan for undergraduate students with a fixed interest rate and no repayment required until after graduation.

- Direct Unsubsidized Loan: A loan for both undergraduate and graduate students with a fixed interest rate, where the borrower is responsible for paying interest on the loan.

- Federal Student Loan (Ford) Direct Loan Program: A loan program that provides low-interest loans to students pursuing higher education.

- Perkins Loan: A need-based loan for undergraduate and graduate students, with a fixed interest rate and no repayment required until after graduation.

The Application Process and Requirements for FAFSA Loans

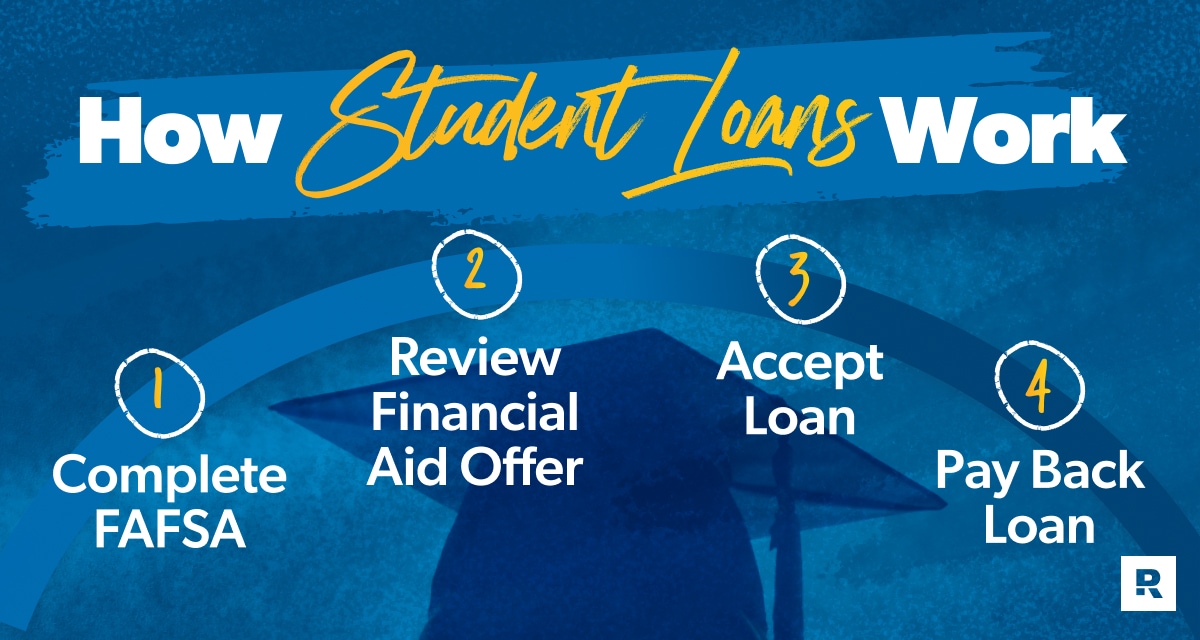

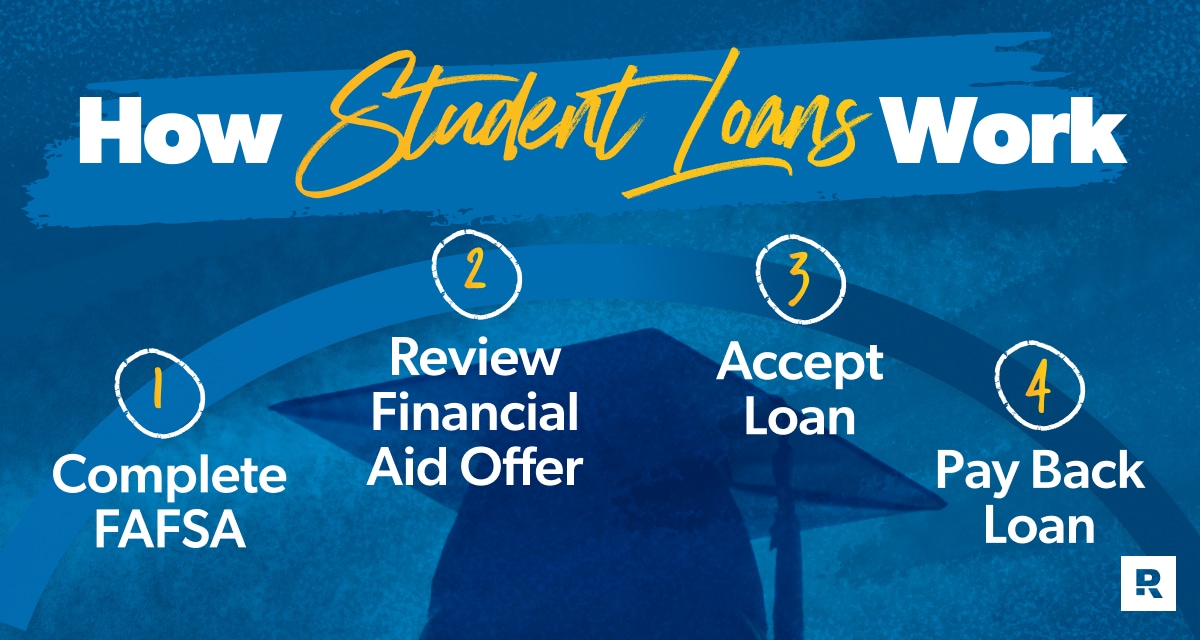

To apply for FAFSA loans, you’ll need to:

- Fill out the Free Application for Federal Student Aid (FAFSA)

- Prioritize your financial aid needs

- Complete any necessary verification steps

- Review and accept your student loan offer

How to Manage Your Loan Debt Effectively

To manage your FAFSA student loans effectively:

- Create a budget and track your expenses

- Prioritize your debt repayment

- Consider income-driven repayment plans or loan forgiveness programs

- Communicate with your lender if you’re having trouble making payments

By understanding how FAFSA student loans work, you’ll be better equipped to make informed decisions about your financial aid options and achieve your academic goals. For more information on FAFSA student loans, visit the U.S. Department of Education’s StudentAid.gov.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions: How Do FAFSA Student Loans Work

-

Q: What is the Free Application for Federal Student Aid (FAFSA) and why do I need to complete it?

A: The FAFSA is a form that students must submit each year to determine their eligibility for financial aid, including student loans. You need to complete the FAFSA because many colleges and universities require it as part of the application process, and it helps determine your financial need.

-

Q: What types of student loans are available through FAFSA?

A: The main types of student loans available through FAFSA are subsidized and unsubsidized federal Stafford Loans, Perkins Loans, and Direct PLUS Loans. Additionally, FAFSA also determines eligibility for work-study programs.

-

Q: How do I determine my Expected Family Contribution (EFC) on the FAFSA?

A: Your EFC is calculated based on information you provide about your family’s income, assets, and benefits. The EFC formula takes into account factors such as your parents’ income and assets if you’re a dependent student, or your own income and assets if you’re an independent student.

-

Q: What is the difference between subsidized and unsubsidized federal Stafford Loans?

A: Subsidized federal Stafford Loans do not accrue interest while you’re enrolled at least half-time in college, whereas unsubsidized federal Stafford Loans do accrue interest. However, both types of loans require repayment after graduation or withdrawal from school.

-

Q: Can I consolidate my student loans if I’ve taken out multiple loans through FAFSA?

A: Yes, you can consolidate your federal student loans to simplify payments and potentially lower interest rates. Consolidation combines multiple loans into one loan with a single monthly payment and a fixed interest rate.

Conclusion

In conclusion, understanding how FAFSA student loans work is crucial to making informed decisions about your financial aid options. By familiarizing yourself with the different types of federal student loans available through FAFSA, the application process and requirements, and effective loan management strategies, you’ll be better equipped to navigate the complex world of financial aid.

Whether you’re a first-time college student or a returning adult learner, this guide has provided you with the knowledge and tools needed to make informed decisions about your FAFSA student loans. Remember to create a budget and track your expenses, prioritize your debt repayment, consider income-driven repayment plans or loan forgiveness programs, and communicate with your lender if you’re having trouble making payments.

By taking control of your financial aid options, you’ll be able to focus on achieving your academic goals without the burden of excessive student loan debt. For more information on FAFSA student loans, visit the U.S. Department of Education’s StudentAid.gov.

Same day payday loans for bad credit instant access to cash: Struggling with unexpected expenses and no savings? Same day payday loans offer an instant solution! Get instant access to cash without the hassle of lengthy approval processes.

Guaranteed approval best bad credit payday loans: Are you tired of rejection letters from lenders? Guaranteed approval payday loans are here to help! Get the cash you need without the fear of rejection.

Same day online payday loan quick cash solution: Need cash fast? Same day online payday loans provide a speedy solution! Get instant approval and access to cash within hours.