Unlocking Your Student Loan Account Number for IRS Compliance

If you’re a student loan borrower, you might be wondering how to find your student loan account number for IRS purposes. You’re not alone! Many students and borrowers struggle with this seemingly simple question, leading to frustration and confusion.

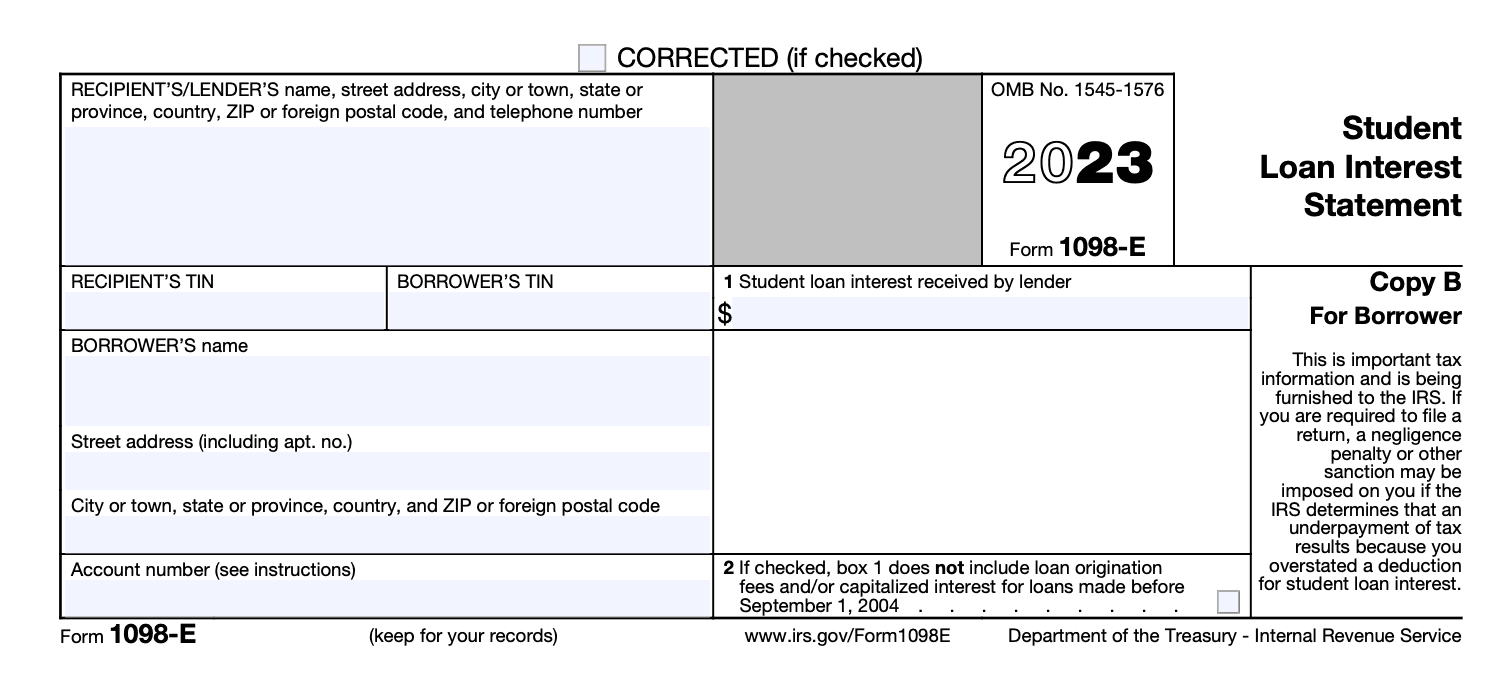

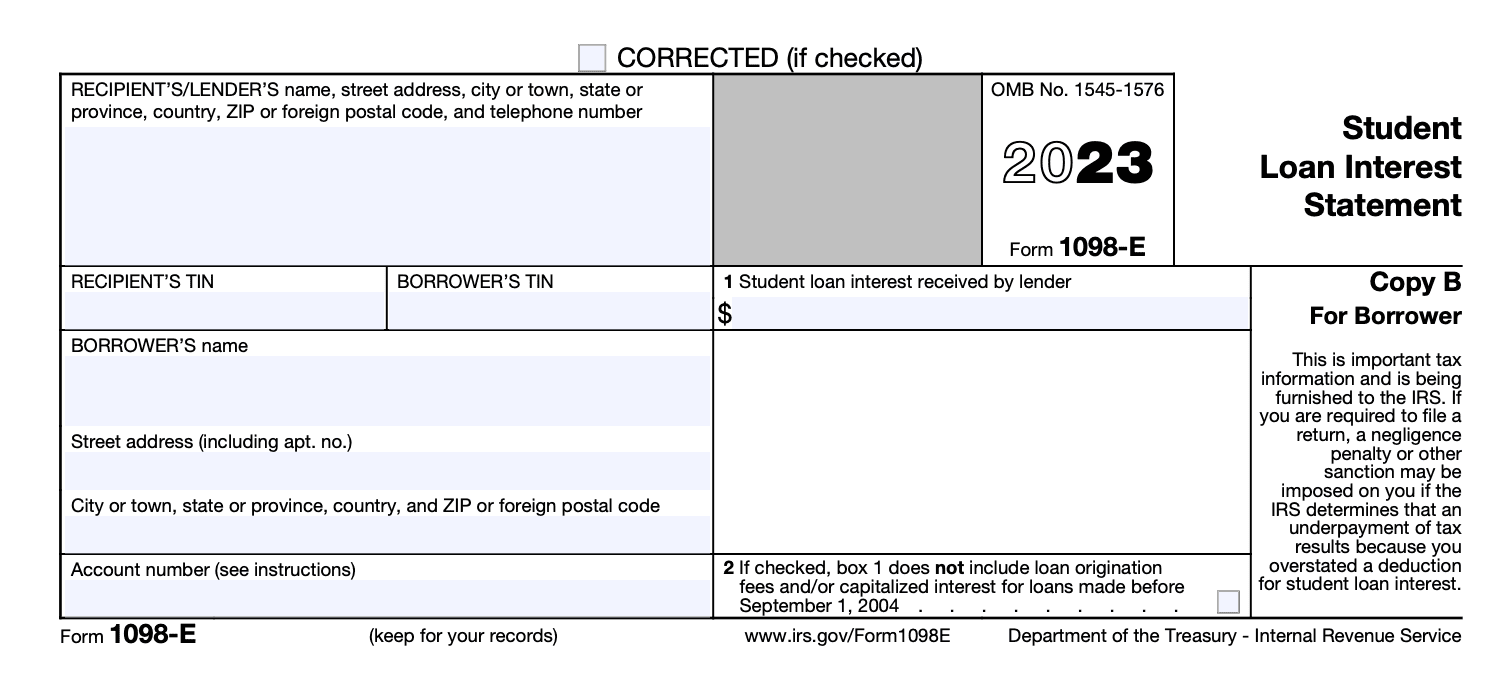

As the tax filing season approaches, it’s essential to have all necessary documents in order, including your student loan information. However, without knowing your student loan account number, you may be unable to provide accurate information on your tax return or risk facing penalties and fines. But fear not! In this article, we’ll guide you through the process of finding your student loan account number for IRS compliance.

With our step-by-step instructions and expert tips, you’ll be well-equipped to navigate the often-complex world of student loans and tax filing. So, let’s get started!

How Do I Find My Student Loan Account Number For IRS?

To find your student loan account number for IRS purposes, follow these steps:

Step 1: Determine Your Lender You can either have a federal student loan or a private student loan. If you’re unsure which type of loan you have, check your promissory note or contact your servicer directly.

Visit Federal Student Aid’s website to learn more about federal student loans and their account numbers.Step 2: Obtain Your Account Number (Federal Loans) If you have a federal student loan, you can find your account number on:

- Your promissory note or consolidation loan agreement

- Your loan servicing statement

- Contact your federal loan servicer directly and ask for your account number

Step 3: Obtain Your Account Number (Private Loans) For private student loans, you can find your account number on:

- Your promissory note or loan agreement

- Contact your private loan servicer directly and ask for your account number

Remember to keep your account number secure, just like a social security number. It’s essential to have this information handy when filing your taxes.

Visit the IRS website for more information on tax filing and compliance.Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFAQs: How Do I Find My Student Loan Account Number For IRS

-

Q: What is my student loan account number and why do I need it for the IRS?

A: Your student loan account number, also known as your Federal Student Aid (FSA) ID, is a unique identifier assigned to you by the Department of Education. You’ll need it to report your income and claim certain tax credits on your tax return.

-

Q: Where can I find my student loan account number?

A: You can log in to your Federal Student Aid (FSA) account or contact the National Student Loan Data System (NSLDS) for assistance. If you’re having trouble finding it, you may want to check with your student loan servicer or lender.

-

Q: What if I’ve forgotten my FSA ID login credentials?

A: Don’t worry! You can reset your password and regain access to your account. Just visit the Federal Student Aid website, click on “Forgot Password,” and follow the prompts.

-

Q: Can I use my student loan account number for other purposes besides IRS reporting?

A: Yes! Your FSA ID can be used to access your student loan information, request a copy of your tax transcript, and even apply for federal student aid in the future.

Conclusion: Uncovering Your Student Loan Account Number for IRS Compliance

In this article, we’ve demystified the process of finding your student loan account number for IRS purposes. By following our step-by-step guide and expert tips, you now possess the knowledge to navigate the often-complex world of student loans and tax filing.

Remember, having accurate and up-to-date information about your student loans is crucial for IRS compliance. With your account number in hand, you’ll be well-equipped to report your income and claim certain tax credits on your tax return.

If you’re unsure about any aspect of the process or have further questions, we’ve also provided a comprehensive FAQ section to guide you through any challenges you may encounter.

As the tax filing season approaches, it’s essential to prioritize accuracy and timeliness when submitting your tax return. By understanding how to find your student loan account number for IRS purposes, you’ll be one step closer to achieving this goal.

Visit the IRS website for more information on tax filing and compliance.Consolidate Smart Option Student Loan: A Comprehensive Guide: Get a clear understanding of how to consolidate your smart option student loan, including tips and strategies for reducing payments and simplifying your financial situation. Click the link to learn more about streamlining your student loans!

Can I Get a Student Loan Consolidation with Chapter 13?: Are you struggling to make payments on your student loan while in Chapter 13 bankruptcy? Our guide explores the options and considerations for consolidating your student loans during this financial restructuring process. Find out what steps you can take to get back on track!

Same Day Payday Loans Online: Instant Cash Relief: Don’t let financial emergencies weigh you down. Discover how same day payday loans can provide the quick cash relief you need, with our expert guide on the application process and what to expect. Click the link for instant access!