How Long Did It Take You to Pay Off Your Student Loans?

If you’re one of the millions of Americans struggling with student loan debt, you’re not alone. The burden of repaying student loans can be overwhelming, leaving many wondering how they’ll ever achieve financial freedom.

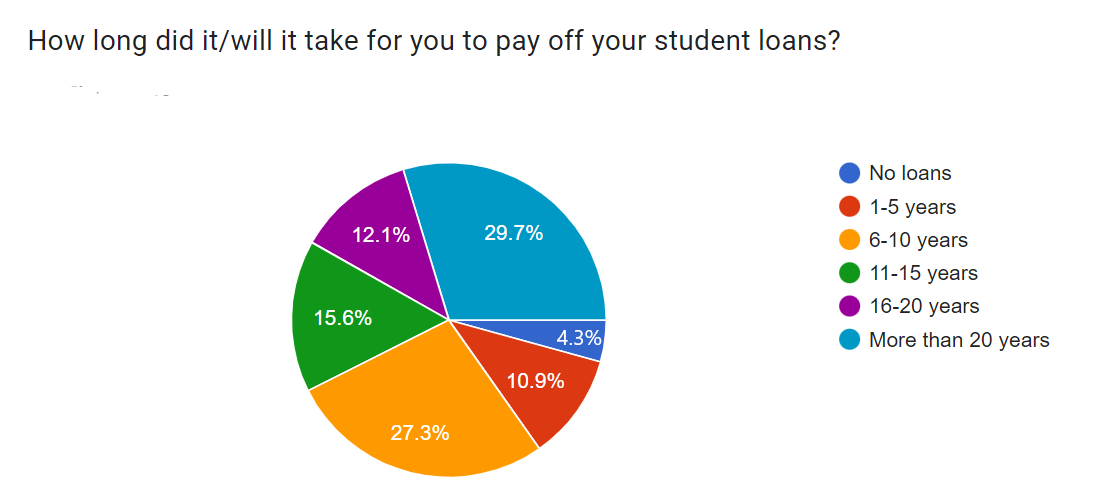

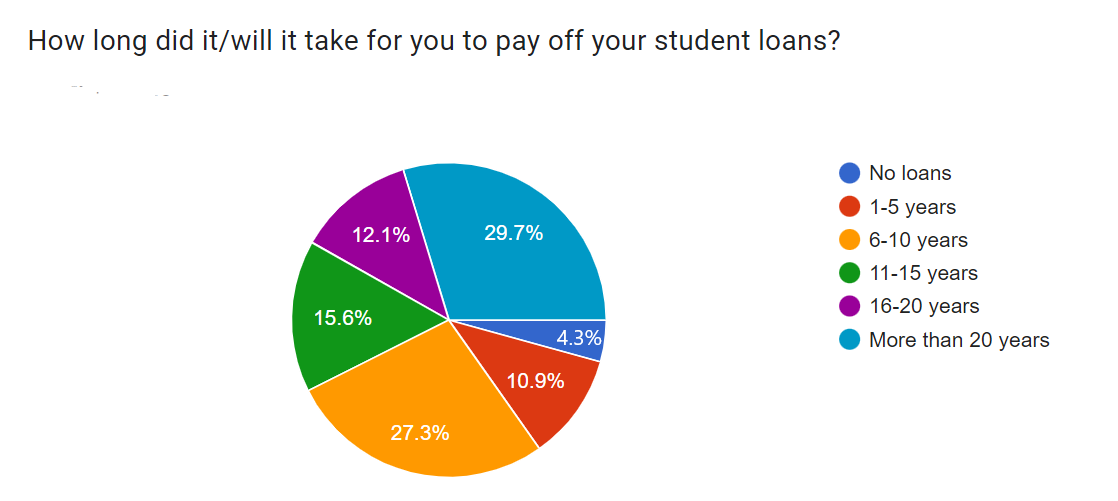

In fact, according to a recent survey, the average American graduate has over $30,000 in student loan debt. And for those who pursued advanced degrees or specialized fields, that number can quickly escalate to six figures or more.

But here’s the thing: you’re not stuck with this financial weight forever. The key is understanding how long it takes to pay off your student loans and developing a strategy to tackle them head-on. In this article, we’ll explore what factors influence repayment timelines, share real-life examples of people who’ve successfully paid off their loans, and provide actionable tips for getting ahead of the game.

So, if you’re ready to break free from the shackles of student loan debt, keep reading! We’ll dive into the world of student loan repayment and explore what it takes to achieve financial liberation.

How Long Did It Take You to Pay Off Your Student Loans?

If you’re one of the millions of Americans struggling with student loan debt, you’re not alone. The burden of repaying student loans can be overwhelming, leaving many wondering how they’ll ever achieve financial freedom.

In fact, according to a recent National Center for Education Statistics, the average American graduate has over $30,000 in student loan debt. And for those who pursued advanced degrees or specialized fields, that number can quickly escalate to six figures or more.

But here’s the thing: you’re not stuck with this financial weight forever. The key is understanding how long it takes to pay off your student loans and developing a strategy to tackle them head-on. Factors such as income level, loan amount, interest rate, and repayment plan can all impact the length of time it takes to repay student loans.

For example, those with higher incomes may be able to make larger payments and pay off their loans more quickly, while those with lower incomes may need to take a longer-term approach. Additionally, loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), can also impact the timeline for paying off student loans.

In this article, we’ll explore what factors influence repayment timelines, share real-life examples of people who’ve successfully paid off their loans, and provide actionable tips for getting ahead of the game.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

Q: What is considered a “long” time to pay off student loans?

A: The definition of “long” can vary depending on individual circumstances and loan terms. Generally, paying off student loans within 5-7 years after graduation is considered relatively quick, while taking 10+ years may be considered longer.

Q: Can I pay off my student loans faster?

A: Yes, you can pay off your student loans faster by increasing your monthly payments, making extra payments, or using bi-weekly payments instead of monthly ones. You should also consider consolidating federal loans to a single loan with a lower interest rate.

Q: Will paying off my student loans early affect my credit score?

A: Paying off your student loans early can actually have a positive impact on your credit score, as it shows lenders you’re responsible and able to manage debt effectively. However, be cautious not to close old accounts or make large purchases immediately after paying off loans, as this could negatively affect your credit utilization ratio.

Q: Can I get forgiveness or discharge for my student loans?

A: Yes, there are certain circumstances under which you may qualify for loan forgiveness or discharge. These include public service loan forgiveness, teacher loan forgiveness, and discharge due to permanent disability. You should research these options and consult with your lender to see if you’re eligible.

Q: How can I stay motivated to pay off my student loans?

A: Staying motivated is crucial! Set specific goals, celebrate small victories, and remind yourself why you’re working towards debt freedom. You can also consider enlisting the help of a financial advisor or joining a support group with others who are going through similar experiences.

Conclusion

Paying off student loans can be a significant milestone in achieving financial freedom. By understanding how long it takes to pay off your student loans and developing a strategy to tackle them head-on, you can take control of your debt and start building a brighter financial future.

In this article, we’ve explored the factors that influence repayment timelines, shared real-life examples of people who’ve successfully paid off their loans, and provided actionable tips for getting ahead of the game. Whether you’re looking to pay off your student loans quickly or develop a long-term plan, understanding your options and staying motivated can make all the difference.

Remember, paying off student loans early can have a positive impact on your credit score and provide a sense of financial liberation. With the right approach, you can say goodbye to student loan debt and hello to a more secure financial future.

Get Online Payday Loans Same Day: Don’t let financial emergencies wait another day! This article reveals how to get instant cash relief with online payday loans, even if you have bad credit. Learn the secrets to same-day funding and say goodbye to money worries.

Same Day Payday Loans for Bad Credit: Instant Access to Cash: Need cash fast, but worried about your credit score? This article shows you how to get same-day payday loans with bad credit, providing instant access to cash when you need it most. Discover the lenders that offer flexible financing options and no credit checks.

Same Day Payday Loans Online: Instant Cash Relief: Run out of cash before your next paycheck? This article helps you get same-day payday loans online, providing instant cash relief from financial emergencies. Learn how to apply quickly and securely, and gain peace of mind with fast funding.