Worried About Your Student Loan Payments?

Are you one of the millions of students struggling to make ends meet with a $50,000 student loan debt? You’re not alone! As the cost of higher education continues to rise, it’s no surprise that many graduates are left wondering how they’ll ever be able to pay off their loans.

How Much Are the Student Loan Payments on a $50,000?

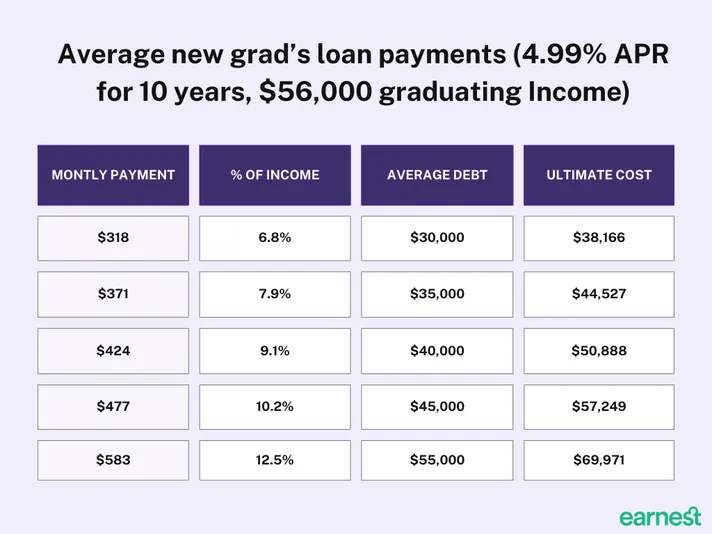

In this article, we’ll dive into the specifics of student loan payments and provide you with a breakdown of exactly how much you can expect to pay each month based on your debt level. With the average student loan debt now exceeding $31,000 per borrower, it’s crucial to understand the impact of interest rates and repayment terms on your overall financial well-being.

Whether you’re just starting out or are already navigating the complexities of student loan repayment, this guide is designed to empower you with the knowledge and tools you need to take control of your debt and start building a brighter financial future. So let’s get started!

How Much Are the Student Loan Payments on a $50,000?

The federal student loan repayment plan for Direct Loans offers several options for borrowers to manage their debt. The standard repayment plan typically has a fixed monthly payment amount that’s calculated based on the total outstanding balance and the interest rate.

For a $50,000 student loan debt, the average monthly payment under the standard repayment plan would be around $656 per month (1). This amount is based on an interest rate of 6.28% and a repayment period of 10 years.

However, the actual payment amount may vary depending on your individual circumstances. For instance, if you’re experiencing financial hardship or have a variable income, you might consider enrolling in an Income-Driven Repayment (IDR) plan (2). These plans offer more flexible repayment terms and may result in lower monthly payments.

It’s essential to note that while the standard repayment plan can help you pay off your debt quickly, it may not be the most cost-effective option. A longer repayment period, such as the 20-year extended repayment plan, could result in a lower monthly payment amount but more interest paid over time (3).

Ultimately, choosing the right student loan repayment plan for your $50,000 debt requires careful consideration of your financial situation and goals. It’s recommended that you consult with a financial advisor or use online tools to determine the best course of action for your individual circumstances (4).

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

Q: How much will my student loan payments be on a $50,000 loan?

A: The amount of your student loan payments depends on several factors, including the type of loan, interest rate, and repayment term. For a $50,000 loan with an average interest rate of 4.5%, here are some estimated monthly payment amounts:

- 10-year repayment term: $545-$585 per month

- 15-year repayment term: $370-$410 per month

- 20-year repayment term: $285-$325 per month

In conclusion, understanding how much you’ll need to pay each month for your $50,000 student loan debt can be a crucial step in taking control of your financial well-being. Whether you’re considering the standard repayment plan or exploring Income-Driven Repayment options, it’s essential to weigh the pros and cons of each approach based on your individual circumstances.

By carefully considering your financial situation and goals, you can make an informed decision about which student loan repayment plan is right for you. Remember to consult with a financial advisor or use online tools to determine the best course of action for your unique situation.

Same Day Payday Loans Online No Credit Check Direct Lenders Available: Need a payday loan as soon as possible? This article reveals the top same day payday loans online that don’t require a credit check, giving you instant access to cash when you need it most. Click here to learn more!