How Much Is The Student Loan Debt?

The thought of student loan debt is a daunting reality for many students and young adults today. With the rising costs of higher education, it’s no surprise that the amount of student loan debt has reached staggering proportions.

But just how much is the average student loan debt? Is it possible to pay off this massive burden, or are we stuck with a lifelong sentence of financial hardship?

A Crushing Burden

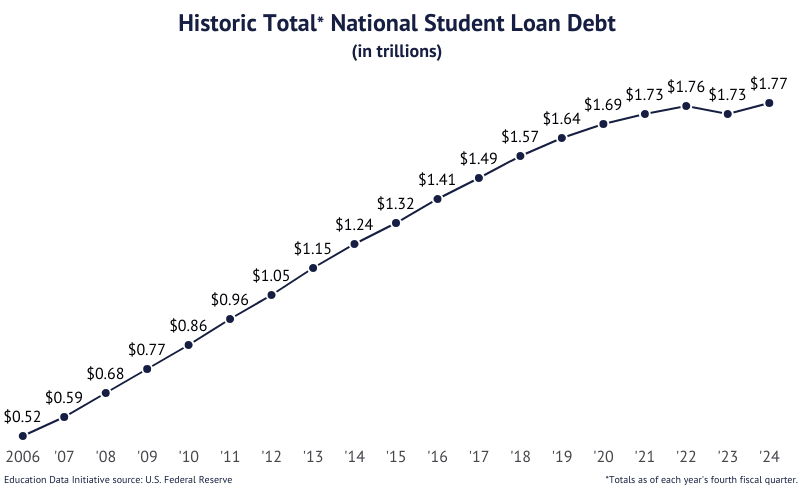

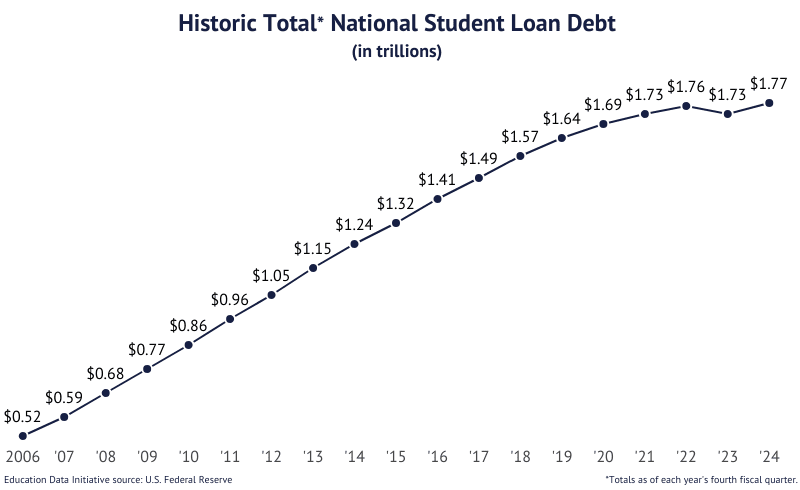

The National Association of Student Financial Aid Administrators estimates that the total outstanding student loan debt in the United States is a whopping $1.6 trillion.

This staggering amount of debt has left many students and young adults feeling overwhelmed, stressed, and unsure of how to pay off their loans.

Are you struggling with student loan debt? Do you want to know what you can do to manage your debt and start building a brighter financial future?

How Much Is The Student Loan Debt?

The thought of student loan debt is a daunting reality for many students and young adults today. With the rising costs of higher education, it’s no surprise that the amount of student loan debt has reached staggering proportions.

According to the National Association of Student Financial Aid Administrators, the total outstanding student loan debt in the United States is a whopping $1.6 trillion.

This staggering amount of debt has left many students and young adults feeling overwhelmed, stressed, and unsure of how to pay off their loans.

A Crushing Burden

For many students, the thought of repaying this massive debt can be a significant source of anxiety. With interest rates and repayment terms varying widely depending on the type of loan and lender, it’s no wonder that student loan debt has become a major concern.

Whether you’re currently struggling with student loan debt or are concerned about the impact it may have on your future financial plans, understanding the scope of this issue is crucial to finding effective solutions.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

-

Q: What is the average student loan debt?

A: According to a report by the Institute for College Access & Success, the average student loan debt in the United States is around $31,300. However, this number can vary greatly depending on factors such as the type of institution attended, major studied, and location.

-

Q: What is the highest student loan debt per capita?

A: The state with the highest average student loan debt per capita is West Virginia, with an average debt of $44,000. This is due in part to the state’s low median household income and high tuition rates for public colleges.

-

Q: How does student loan debt affect credit scores?

A: Student loan debt can have a significant impact on credit scores. Missed payments, late fees, and other negative marks on your credit report can lower your score, making it more difficult to obtain new loans or credit in the future. It’s essential to prioritize repayment and communicate with lenders if you’re having trouble making payments.

-

Q: Can student loan debt be forgiven?

A: In some cases, student loan debt can be forgiven through programs such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. Additionally, some employers offer forgiveness programs for employees who work in certain fields or industries. It’s essential to research these options and explore all avenues for debt relief.

Conclusion

The staggering amount of student loan debt in the United States is a pressing concern for many students and young adults. With the average student loan debt reaching around $31,300, it’s essential to understand the scope of this issue and explore effective solutions for managing debt.

Whether you’re currently struggling with student loan debt or are concerned about its impact on your future financial plans, prioritizing repayment and seeking debt relief options can make a significant difference. By understanding how student loan debt affects credit scores and exploring forgiveness programs, you can take control of your financial situation and start building a brighter future.

Get cash same day with payday loans: Need quick access to funds? Payday loans can provide same-day funding for emergency expenses. Learn how these short-term loans work and what you need to know before applying.