Mastering Your Finances: A Guide to Finding Student Loan Balance

Are you one of the millions of students struggling to keep track of their student loan balance? You’re not alone! With the rising cost of higher education and increasing debt, it’s no wonder many students are finding themselves overwhelmed by the complexity of managing their loans.

Having a clear understanding of your student loan balance is crucial for making informed decisions about your financial future. But where do you even start? In this guide, we’ll take the mystery out of tracking and managing your student loans. You’ll learn how to:

(Primary Keyword: Student Loan Balance)

Mastering Your Finances: A Guide to Finding Student Loan Balance

To find your student loan balance, start by gathering the necessary documents. You’ll need your most recent loan statements from each of your lenders or loan servicers. You can typically access these online through your lender’s website or through the National Student Loan Data System (NSLDS) at nslds.ed.gov.

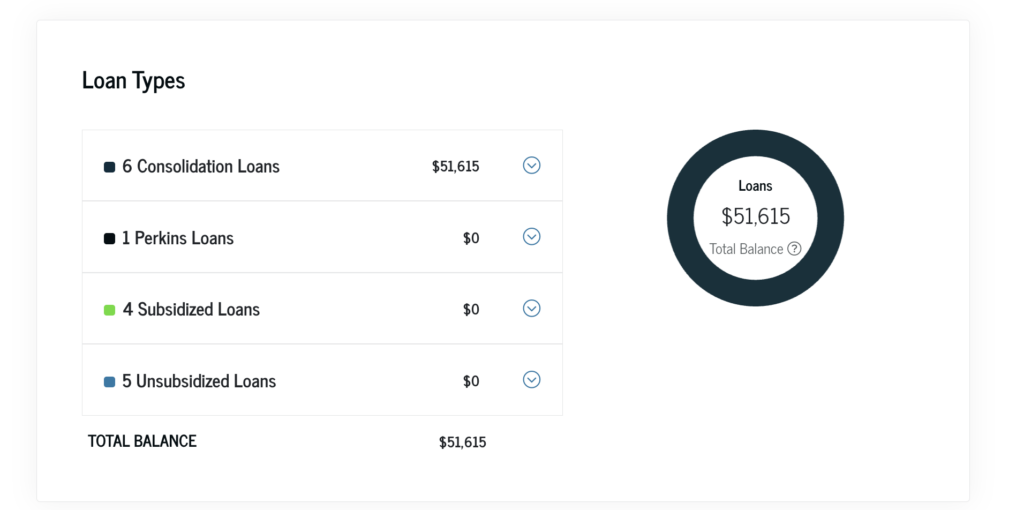

Next, create a list of all your student loans, including federal and private loans. Be sure to include the loan type, interest rate, and minimum monthly payment for each. You can use a spreadsheet or a note-taking app to make it easier to organize this information.

Once you have all your loan information in one place, calculate your total student loan debt by adding up the balances of all your loans. This will give you a clear picture of how much you owe and what your overall financial situation looks like.

If you’re having trouble tracking down all your loan documents or need help understanding your loan statements, consider reaching out to your lender or loan servicer directly. They may be able to provide you with the information you need or offer additional guidance on managing your loans.

Additionally, you can use online tools and resources to help you track and manage your student loans. The Federal Student Aid (FSA) website at studentaid.gov offers a range of resources and tools to help borrowers navigate the process of repaying their student loans.

By taking these steps, you’ll be well on your way to mastering your finances and finding your student loan balance. Remember, understanding your debt is the first step towards creating a plan to pay it off and achieve financial stability.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

-

Q: How do I find my student loan balance?

Conclusion

Finding your student loan balance is a crucial step in mastering your finances and taking control of your debt. By gathering your loan statements, creating a list of your loans, and calculating your total student loan debt, you’ll have a clear understanding of your financial situation.

Remember to use online tools and resources, such as the Federal Student Aid website, to help you track and manage your student loans. If you’re having trouble finding or understanding your loan documents, don’t hesitate to reach out to your lender or loan servicer for assistance.

By following these steps and staying informed about your student loans, you’ll be well on your way to achieving financial stability and paying off your debt. Take control of your finances today and start building a brighter financial future.

Same day deposit online payday loans: fast access to emergency funds: Are you in need of a financial lifeline? Learn how same day deposit online payday loans can provide instant cash relief and get back on your feet quickly. Explore the benefits and risks associated with this type of loan, and discover how it can be a lifesaver during unexpected expenses.

Same day payday loans online: instant cash relief: Struggling to make ends meet? Same day payday loans online can provide the quick injection of cash you need to cover emergency expenses. With our comprehensive guide, learn how these loans work and what to expect from the application process.

Consolidate Smart Option Student Loan: a comprehensive guide: Are you drowning in student loan debt? Discover how consolidating your Smart Option Student Loan can simplify your payments and save you thousands. Learn the pros, cons, and steps to take control of your finances.