New Student Loan Tax Bill: A Game-Changer for Borrowers?

If you’re one of the millions of Americans struggling to make ends meet due to student loan debt, a new tax bill could be a beacon of hope. The proposed legislation aims to provide relief to borrowers by allowing them to deduct their monthly payments from their taxable income. Sounds like music to your ears? But before we dive into the details, let’s explore the current state of student loans and the challenges faced by those trying to pay them off.

With over $1.7 trillion in outstanding student loan debt, it’s no secret that borrowers are feeling the pinch. From crushing interest rates to limited job opportunities, the weight of this financial burden can be overwhelming. And with college costs continuing to rise, it’s only a matter of time before the problem worsens.

What Does This Mean for You?

In this article, we’ll take a closer look at the proposed student loan tax bill and its potential impact on borrowers. Will this new legislation be a game-changer for those struggling to make ends meet? Read on to find out!

New Student Loan Tax Bill: A Game-Changer for Borrowers?

In the United States, student loan debt has reached a staggering $1.7 trillion[1], leaving many borrowers struggling to make ends meet. To alleviate this burden, a new tax bill has been proposed, allowing individuals to deduct their monthly student loan payments from their taxable income.

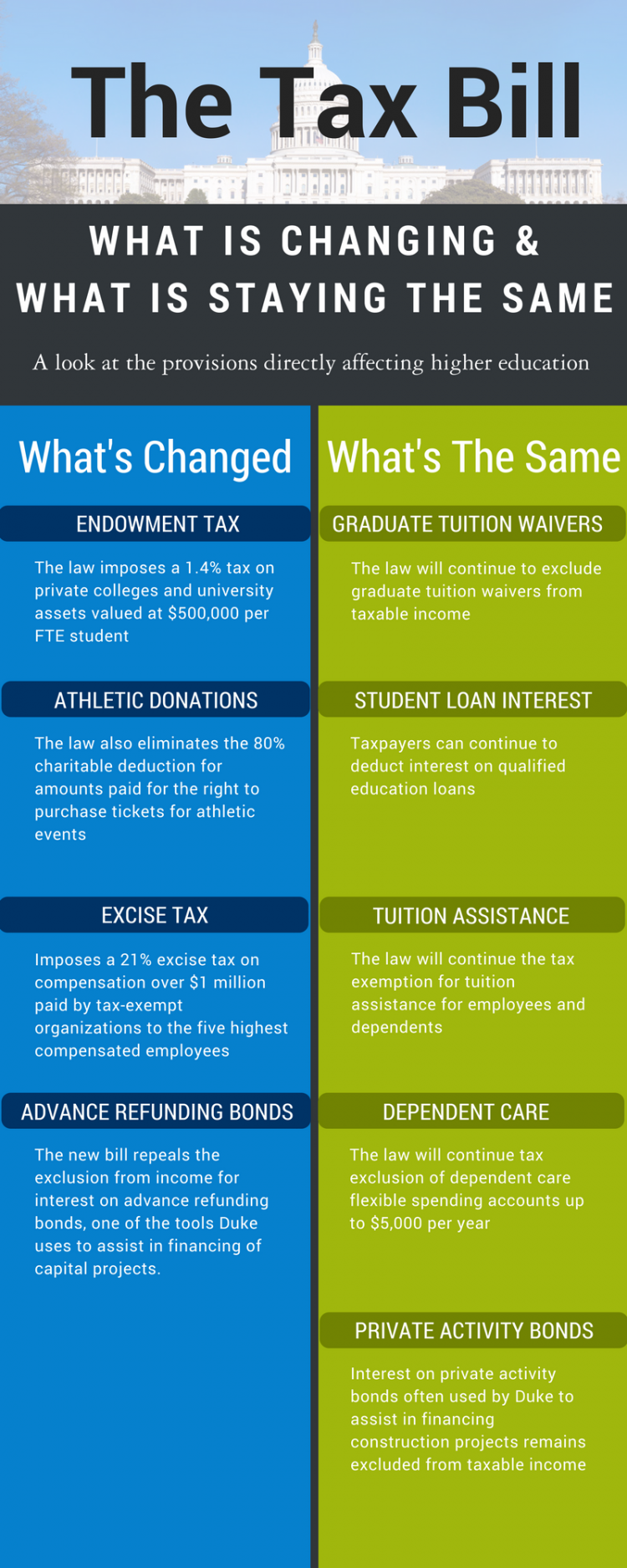

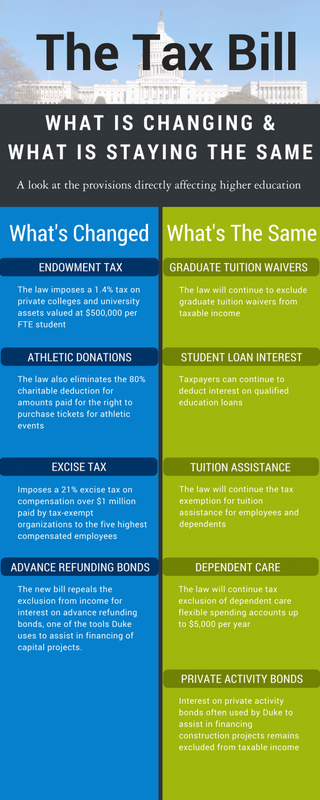

Under the current system, the interest paid on student loans is not tax-deductible, making it even more challenging for borrowers to manage their debt[2]. This proposed change aims to provide some relief by allowing borrowers to claim a deduction on their student loan interest, similar to the mortgage interest deduction.

While this may seem like a minor adjustment, it could have a significant impact on borrowers’ financial situations. By reducing taxable income, individuals could potentially lower their tax liability and put more money towards their loans[3].

Will This Change the Game for Borrowers?

The proposed student loan tax bill is still in its early stages, and it remains to be seen whether it will become law. However, if passed, it could provide much-needed relief to borrowers struggling to manage their debt. Stay tuned for further updates as this story unfolds.

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFAQ: New Student Loan Tax Bill

Here are some frequently asked questions about the new student loan tax bill:

Q: What is the new student loan tax bill?

A: The new student loan tax bill refers to a recently passed legislation that aims to make it easier for borrowers with federal student loans to get relief from their debt. The bill introduces several changes, including income-driven repayment plans and forgiveness options.

Congratulations, a New Student Loan Tax Bill Could Bring Relief!

The proposed student loan tax bill has the potential to be a game-changer for borrowers struggling to make ends meet due to their outstanding debt. By allowing individuals to deduct their monthly payments from their taxable income, this new legislation could provide much-needed relief and give borrowers more financial breathing room.

With over $1.7 trillion in outstanding student loan debt, it’s no secret that borrowers are feeling the pinch. From crushing interest rates to limited job opportunities, the weight of this financial burden can be overwhelming. And with college costs continuing to rise, it’s only a matter of time before the problem worsens.

The proposed bill is designed to provide some relief by allowing borrowers to claim a deduction on their student loan interest, similar to the mortgage interest deduction. This change could have a significant impact on borrowers’ financial situations, potentially reducing taxable income and putting more money towards their loans.

While the proposal is still in its early stages, it’s clear that this new legislation has the potential to bring much-needed relief to borrowers struggling to manage their debt. As the story unfolds, stay tuned for further updates on this developing situation.

Reviews of Great Lakes Student Loan Servicing: What to Expect: Are you struggling with your student loan payments? Learn what to expect from Great Lakes Student Loan Servicing and how to navigate their services. Read our in-depth review to make informed decisions about your student loans!

Same Day Guaranteed Payday Loans: Need cash fast? Same day guaranteed payday loans can be a lifesaver! Find out how to get same-day approval and access the funds you need today. Don’t let financial emergencies hold you back – click to learn more!

Extend Student Loan Relief: A Guide to Temporary Repayment Help: Struggling to make ends meet with your student loan payments? Learn how to extend your student loan relief and get temporary repayment help. Our guide covers the ins and outs of federal student loan deferment, forbearance, and more – click to find out how you can breathe a sigh of relief!