Struggling to Get a Payday Loan Without Bank Account?

Are you in need of quick cash but don’t have a bank account? You’re not alone. Many people find themselves in unexpected financial situations, and having no bank account can make it even more challenging to get the help they need.

The Struggle is Real

You might be wondering: “How am I supposed to pay my bills, cover emergency expenses, or just make ends meet without a bank account?” It’s a common problem that many face, but there is hope. Payday loans without bank account required are becoming increasingly popular, offering fast approval options and flexible repayment terms.

In this article, we’ll explore the world of payday loans without bank account requirements near me, highlighting the best providers and their unique features. Whether you’re dealing with unexpected expenses, medical bills, or simply need a helping hand to get back on your feet, we’ve got you covered.

If you’re facing financial difficulties without a bank account, don’t worry – there are options available. Payday loans without bank account requirements have gained popularity, offering quick cash solutions and flexible repayment terms.

The Benefits of Payday Loans Without Bank Account

Without a bank account, it can be challenging to manage your finances, pay bills on time, or cover unexpected expenses. Payday loans without bank account requirements offer a lifeline by providing fast approval options and cash advances.

These short-term loans are designed for emergency situations, such as car repairs, medical bills, or rent payments. With no bank account required, you can still get the help you need to stay on top of your finances.

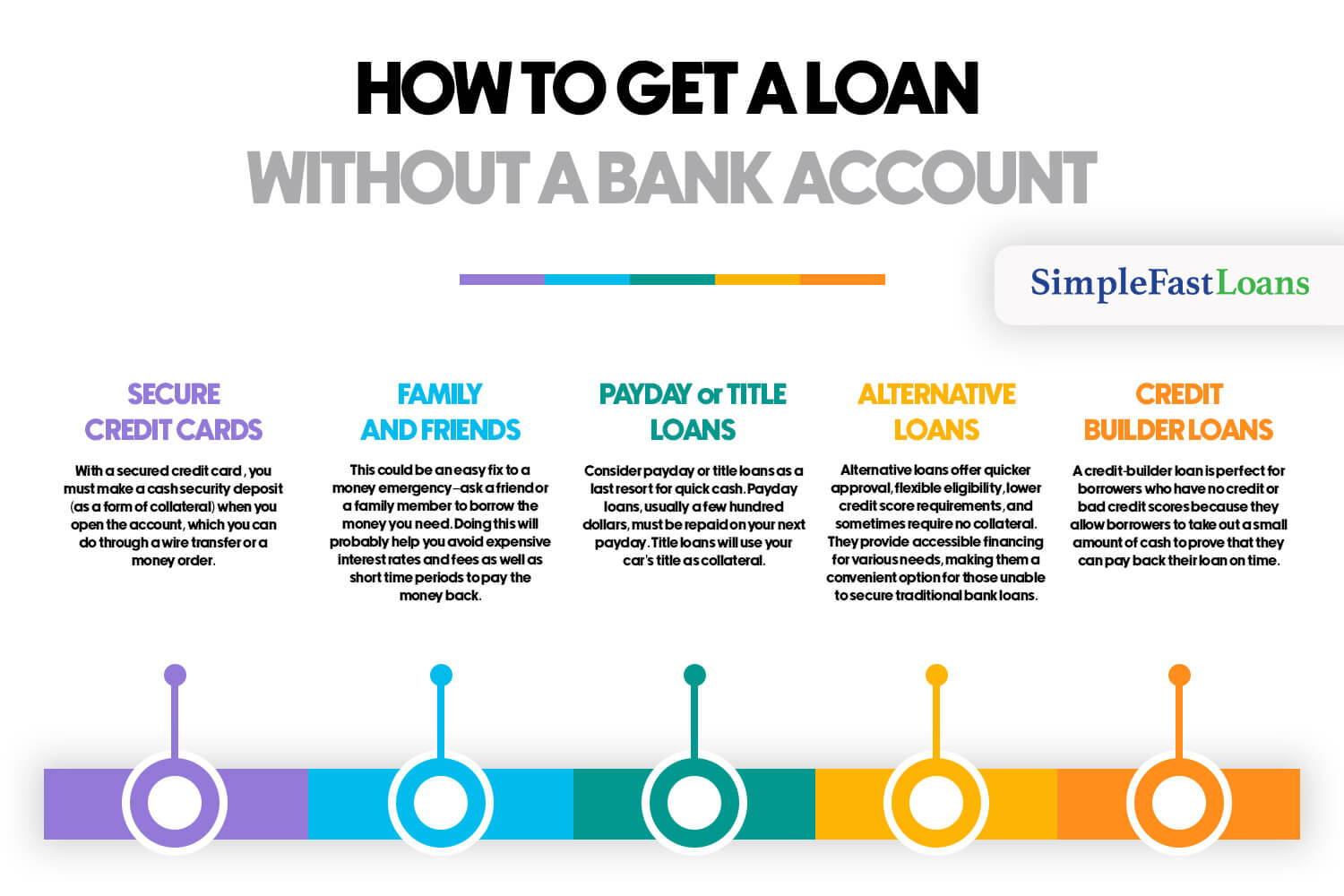

According to the Consumer Financial Protection Bureau, payday loans are meant for short-term financial emergencies and should be used responsibly.While traditional payday lenders require a bank account, some alternative options don’t. These include:

- Payday loan apps, which offer online applications and same-day funding.

- Check-cashing stores, which provide cash advances on paychecks or government benefits.

- Crypto-based payday loans, which use digital currencies instead of traditional banking systems.

When exploring these options, remember to research each provider’s fees, interest rates, and repayment terms to ensure you’re making an informed decision.

To avoid debt traps or predatory lending practices:

- Avoid lenders charging exorbitant interest rates or fees.

- Read and understand the loan agreement before signing.

- Make timely payments to prevent late fees and negative credit reporting.

By staying informed and responsible, you can use payday loans without bank account requirements as a temporary solution to get back on your feet.

🚀 Get Up to $1,500 in Minutes – No Credit Check!

Need Cash Urgently? Free Chat with a Loan Expert Now/p> Get Instant Approval – Chat Now!

Frequently Asked Questions

-

Q: Do I need a bank account to apply for a payday loan without bank account required near me?

A: No, you do not need a bank account to apply for a payday loan. However, some lenders may require alternative payment methods or have specific requirements for disbursement.

-

Q: Are payday loans with no bank account required legit?

A: Yes, payday loans are a legitimate financial option for those in need of short-term cash assistance. However, it’s essential to research and choose a reputable lender that operates within your state’s regulations.

-

Q: How do I get approved for a payday loan without bank account required near me?

A: To increase your chances of approval, ensure you provide accurate and complete application information. Some lenders may consider alternative credit sources or have different approval criteria.

-

Q: Can I use a payday loan to cover emergency expenses?

A: Yes, payday loans can be used to cover unexpected expenses, such as medical bills, car repairs, or utility bills. However, it’s crucial to have a plan to repay the loan and avoid further financial burdens.

-

Q: Are there any alternative options to payday loans without bank account required near me?

A: Yes, consider exploring other short-term financial options, such as personal loans, credit cards, or installment loans. Be cautious of high-interest rates and fees.

Conclusion

In conclusion, payday loans without bank account requirements near me offer a lifeline for those facing financial difficulties without a traditional bank account. By understanding the benefits and types of these short-term loans, you can make an informed decision about whether they are right for you.

Remember to stay safe by researching each provider’s fees, interest rates, and repayment terms, and avoid lenders charging exorbitant interest rates or fees. With responsible borrowing and timely payments, payday loans without bank account requirements can be a temporary solution to get back on your feet.

As you navigate the world of payday loans without bank account required near me, we hope this article has provided valuable insights and guidance. Whether you’re dealing with unexpected expenses, medical bills, or simply need a helping hand to get back on track, there are options available.

Same day deposit payday loans direct lender no credit check quick approval: Get instant access to same-day deposits with a reputable direct lender, no credit checks required! Find out how you can get your hands on the cash you need in minutes.

Guaranteed approval best bad credit payday loans: Struggling with bad credit? We’ve got you covered! Our guaranteed approval payday loans can provide a lifeline when credit scores are low. Learn more about your options and get approved today!

Can i get a student loan consolidation with chapter 13: Are you drowning in debt and wondering if there’s hope? Student loan consolidation might be the answer, even if you’re going through a Chapter 13 bankruptcy. Discover how to take control of your financial future today!