Scams to Watch Out for: Payday Loan Email Scams

In today’s digital age, it’s essential to be vigilant about email scams that can drain your finances and compromise your personal information. One type of scam that has gained popularity is the payday loan email scam. If you’re struggling to make ends meet or facing financial difficulties, you may have received an email promising a quick fix to your financial woes. But beware! Payday loan email scams are on the rise, targeting individuals who are desperate for financial relief.

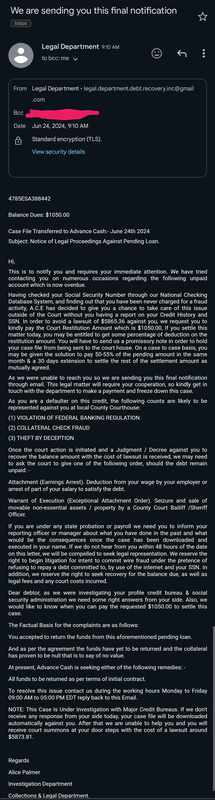

Have you ever received an email claiming to offer a payday loan with ridiculously low interest rates and no credit checks? Or maybe you’ve been sent an urgent message demanding payment for a supposed “overpayment” of a previous loan? If so, you’re not alone. Payday loan email scams are cleverly designed to trick unsuspecting individuals into revealing sensitive financial information or making payments to scammers.

In this article, we’ll delve into the world of payday loan email scams and explore the warning signs, tactics used by scammers, and most importantly, how you can protect yourself from falling prey to these nefarious schemes. Whether you’re a victim of a payday loan scam or simply want to stay safe online, this guide is designed to empower you with the knowledge and tools to safeguard your financial well-being.

Scams to Watch Out for: Payday Loan Email Scams

In today’s digital age, it’s essential to be vigilant about email scams that can drain your finances and compromise your personal information [1]. One type of scam that has gained popularity is the payday loan email scam. If you’re struggling to make ends meet or facing financial difficulties, you may have received an email promising a quick fix to your financial woes. But beware! Payday loan email scams are on the rise, targeting individuals who are desperate for financial relief [2].

Have you ever received an email claiming to offer a payday loan with ridiculously low interest rates and no credit checks? Or maybe you’ve been sent an urgent message demanding payment for a supposed “overpayment” of a previous loan? If so, you’re not alone. Payday loan email scams are cleverly designed to trick unsuspecting individuals into revealing sensitive financial information or making payments to scammers [3].

In this article, we’ll delve into the world of payday loan email scams and explore the warning signs, tactics used by scammers, and most importantly, how you can protect yourself from falling prey to these nefarious schemes. Whether you’re a victim of a payday loan scam or simply want to stay safe online, this guide is designed to empower you with the knowledge and tools to safeguard your financial well-being.

🚀 Get Up to $1,500 in Minutes – No Credit Check!

Need Cash Urgently? Free Chat with a Loan Expert Now/p> Get Instant Approval – Chat Now!

Frequently Asked Questions

-

Q: What is a payday loan email scam?

A: A payday loan email scam is a type of phishing attack where scammers send fake emails or messages claiming to offer payday loans, but are actually trying to steal your personal and financial information.

-

Q: How do I know if an email about a payday loan is legitimate?

A: Be cautious of any email that claims to offer a payday loan or requires you to provide sensitive information. Legitimate lenders will never initiate contact via email, and they’ll always have a physical address and phone number listed on their website. If you’re unsure about the legitimacy of an email, do not respond or click on any links.

-

Q: What should I do if I’ve received a payday loan email scam?

A: Do not respond to the email or click on any links. Delete the email immediately and report it to your email provider as spam. If you’ve already provided personal or financial information, contact your bank and credit card companies to put a freeze on your accounts. Consider placing a fraud alert on your credit reports.

-

Q: How can I protect myself from payday loan email scams?

A: Always be cautious when receiving unsolicited emails or messages about loans. Never provide personal or financial information without verifying the legitimacy of the offer. Use strong, unique passwords for your online accounts and enable two-factor authentication whenever possible. Keep your antivirus software up to date and regularly scan your computer for malware.

In conclusion, payday loan email scams are a growing threat to individuals’ financial well-being. By understanding the tactics used by scammers and the warning signs that indicate an email is not legitimate, you can take steps to protect yourself from falling prey to these nefarious schemes. Remember, never provide sensitive information or make payments to unfamiliar entities, and always verify the legitimacy of loan offers before proceeding.

I have several student loans but only 2 are due now: Are you feeling overwhelmed by multiple student loan payments? Learn how to prioritize your debt and create a plan to tackle those pesky loans. Read the full article to discover a step-by-step guide on managing your finances and staying ahead of the game!