Searching for Personal Loans Just Got Easier!

In today’s fast-paced world, unexpected expenses can arise at any moment, leaving you scrambling to find a solution. Whether it’s an emergency medical bill, a car repair, or a financial emergency, having access to quick and affordable personal loans can be a lifesaver. However, with so many lenders vying for your attention, finding the right loan option can be overwhelming.

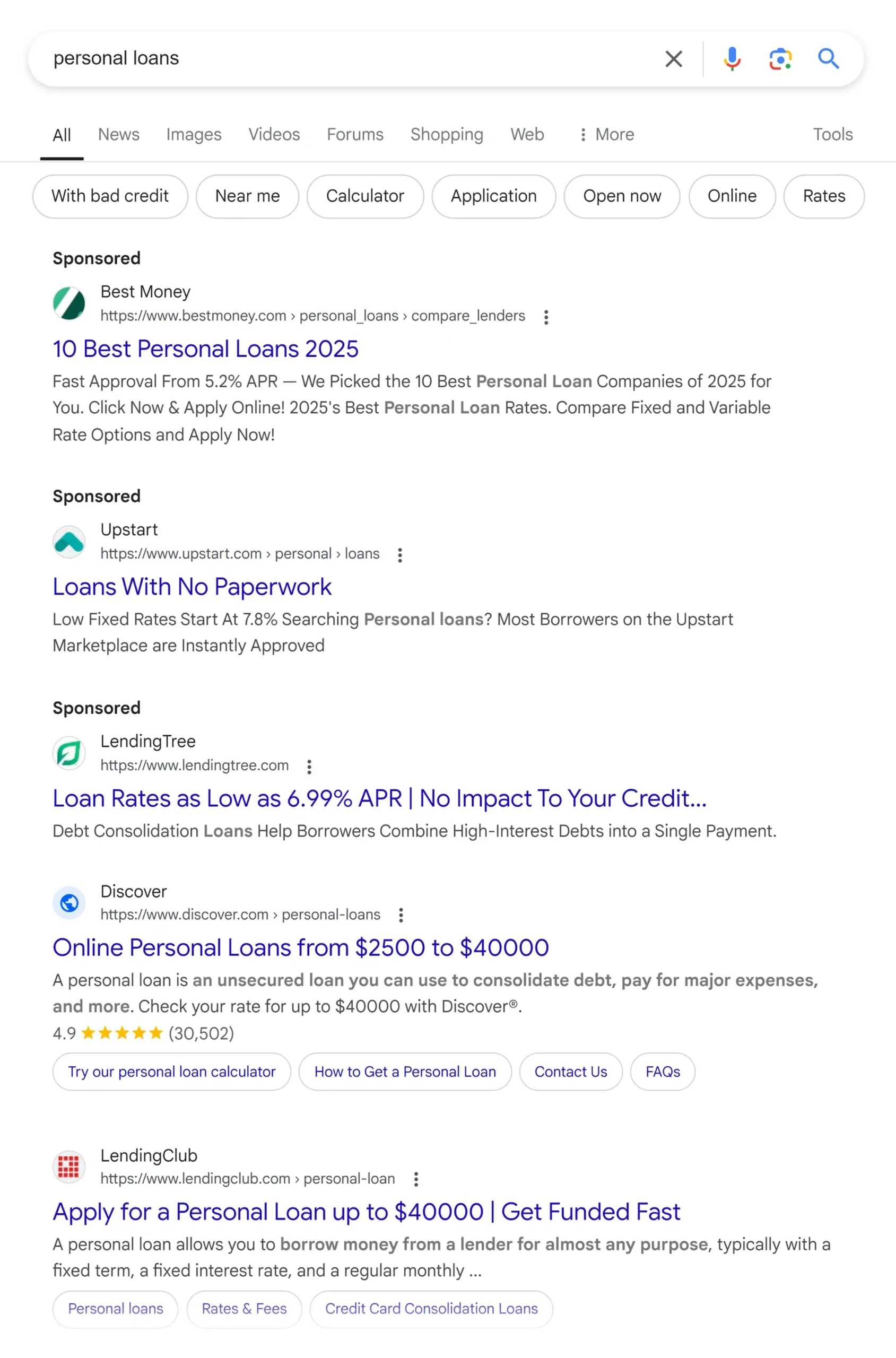

That’s where our search engine for personal loans comes in! By providing you with a comprehensive platform to compare rates, terms, and lenders, we empower you to make an informed decision about your financial future. With just a few clicks, you can:

Compare Loans from Top Lenders

Our advanced search algorithm allows you to filter through various loan options based on factors like interest rates, repayment periods, credit scores, and more. No longer do you have to sift through countless websites or deal with pushy salespeople – we’ve got you covered!

Stay tuned for our in-depth guide on how our search engine for personal loans can simplify your borrowing experience.

Finding the Right Personal Loan Just Got Easier

In today’s fast-paced world, unexpected expenses can arise at any moment, leaving you scrambling to find a solution. Whether it’s an emergency medical bill [1], a car repair, or a financial emergency, having access to quick and affordable personal loans can be a lifesaver. However, with so many lenders vying for your attention, finding the right loan option can be overwhelming.

That’s where our search engine for personal loans comes in! By providing you with a comprehensive platform to compare rates, terms, and lenders, we empower you to make an informed decision about your financial future. With just a few clicks, you can:

Compare Loans from Top Lenders

Our advanced search algorithm allows you to filter through various loan options based on factors like interest rates [2], repayment periods [3], credit scores, and more. No longer do you have to sift through countless websites or deal with pushy salespeople – we’ve got you covered!

Stay tuned for our in-depth guide on how our search engine for personal loans can simplify your borrowing experience.

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions

-

Q: What is a search engine for personal loans?

A: A search engine for personal loans is an online platform that helps individuals find and compare various loan options from multiple lenders, allowing them to make informed decisions about their borrowing needs.

-

Q: How does the search engine work?

A: The search engine uses advanced algorithms to scan a vast database of loan offers and match users with relevant loan options based on their specific financial profiles, credit scores, and borrowing needs.

-

Q: What types of personal loans can I find through the search engine?

A: The search engine aggregates a wide range of personal loan offers from various lenders, including installment loans, payday loans, title loans, and credit-builder loans.

-

Q: Is my personal information safe when using the search engine?

A: Absolutely! The search engine employs robust security measures to protect your personal and financial information, ensuring that it remains confidential and secure throughout the process.

Simplifying Personal Loan Search

In today’s fast-paced world, unexpected expenses can arise at any moment, leaving you scrambling to find a solution. Whether it’s an emergency medical bill, a car repair, or a financial emergency, having access to quick and affordable personal loans can be a lifesaver.

Finding the right loan option among numerous lenders can be overwhelming. That’s why our search engine for personal loans provides a comprehensive platform to compare rates, terms, and lenders, empowering you to make an informed decision about your financial future.

By using advanced algorithms, we’ve made it easy to filter through various loan options based on factors like interest rates, repayment periods, credit scores, and more. No longer do you have to sift through countless websites or deal with pushy salespeople – our search engine has got you covered!

Maine Student Loan Forgiveness Bill: A Comprehensive Guide: Looking to get rid of your student loans in Maine? This comprehensive guide breaks down the ins and outs of the state’s student loan forgiveness program. From eligibility requirements to application processes, get the inside scoop on how to take advantage of this opportunity and start building a debt-free future.