Should I Pay Off My Student Loans Early?

Are you one of the millions of Americans struggling to manage your student loan debt? You’re not alone! Student loans can be a significant burden, and many people wonder if paying them off early is the right decision. But before you start making extra payments, it’s essential to consider your financial situation and goals.

Student loans are a crucial investment in your future, allowing you to pursue higher education and open up more job opportunities. However, they can also be a major financial strain, with high interest rates and long repayment periods. So, is it worth paying off your student loans early? In this post, we’ll explore the pros and cons of early loan repayment and provide tips on how to make the right decision for your situation.

Join us as we dive into the world of student loans and explore whether you should pay them off early or not. Whether you’re just starting out in your career or looking to free up more cash for other financial goals, this post is designed to help you make an informed decision about your student loan debt.

Should I Pay Off My Student Loans Early? The Pros and Cons

(Content will follow)

Should I Pay Off My Student Loans Early?

Are you one of the millions of Americans struggling to manage your student loan debt? You’re not alone! Student loans can be a significant burden, and many people wonder if paying them off early is the right decision. But before you start making extra payments, it’s essential to consider your financial situation and goals.

Student loans are a crucial investment in your future, allowing you to pursue higher education and open up more job opportunities. However, they can also be a major financial strain, with high interest rates and long repayment periods. So, is it worth paying off your student loans early? In this post, we’ll explore the pros and cons of early loan repayment and provide tips on how to make the right decision for your situation.

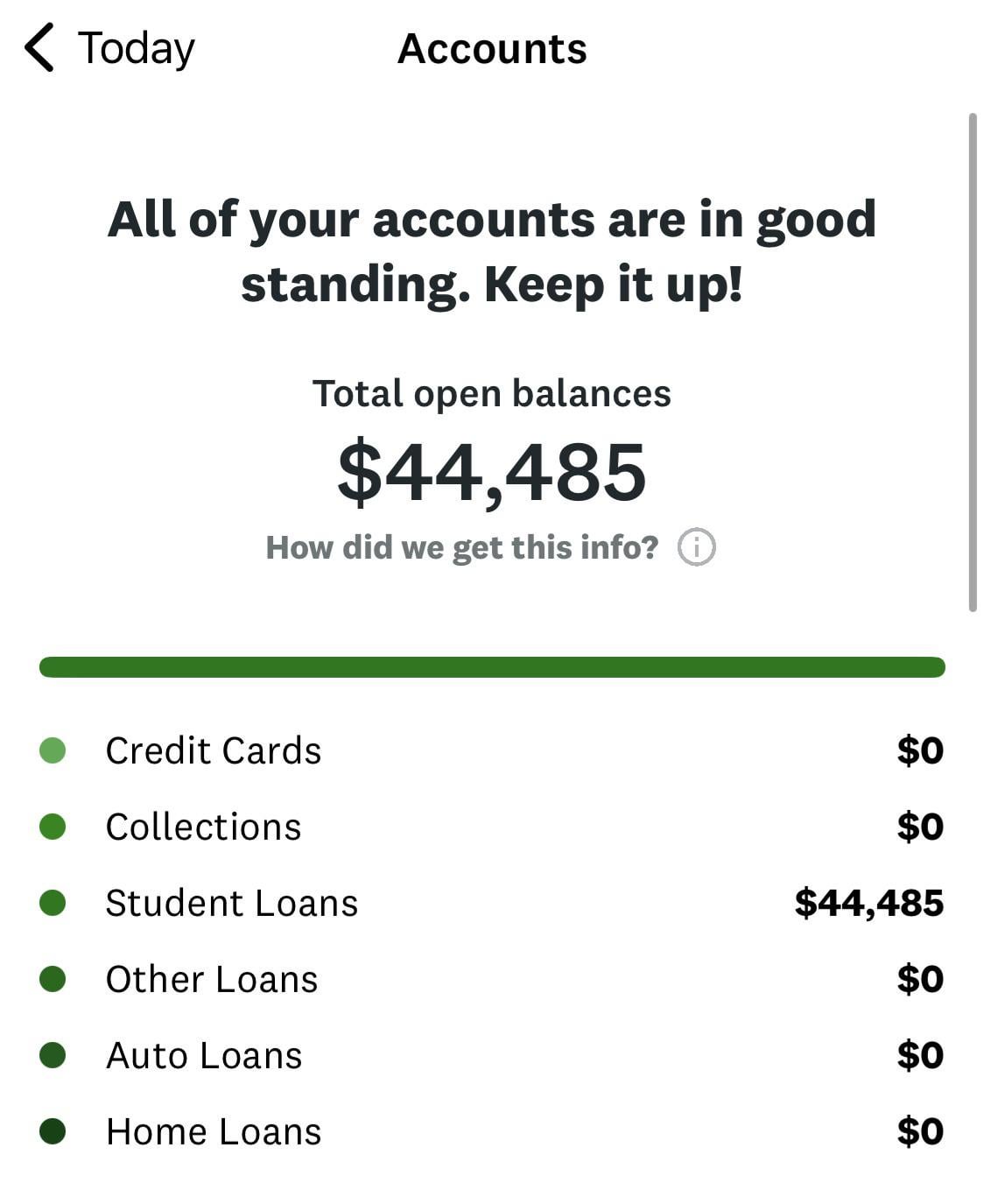

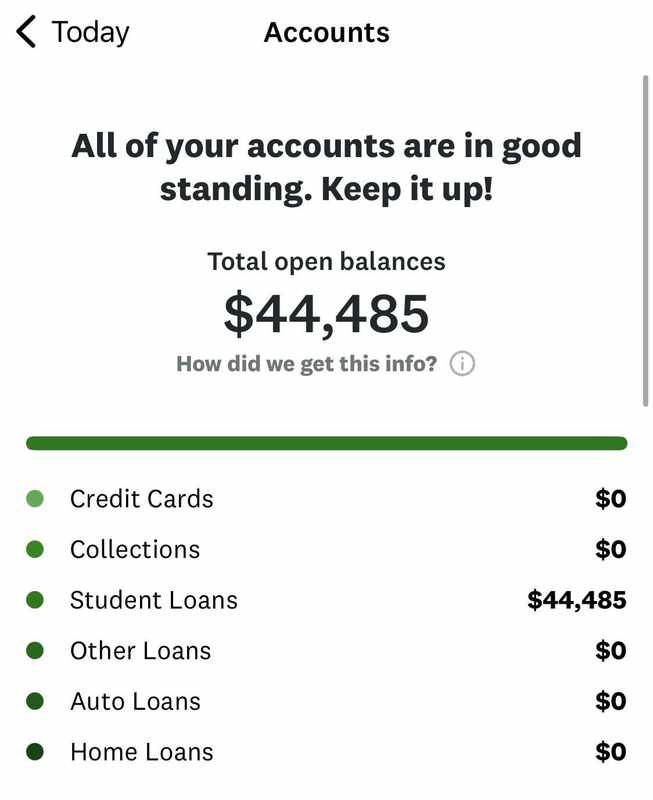

One of the main benefits of paying off student loans early is the potential savings on interest. According to the Federal Reserve, the average student loan debt per borrower in 2020 was around $31,300 [1]. By paying off your loans quickly, you can reduce the amount of interest you’ll pay over time. For example, if you have a $30,000 loan with a 6% interest rate and a 10-year repayment term, you’ll end up paying around $43,000 in total [2]. But if you can pay off the loan in 5 years instead of 10, you’ll save around $7,500 in interest.

Another advantage of early repayment is that it can help improve your credit score. When you make consistent payments and reduce your debt-to-income ratio, you demonstrate to lenders that you’re responsible with credit. This can lead to better loan offers and lower interest rates for future borrowing [3].

However, there are also some potential downsides to consider before paying off your student loans early. For instance, you might be giving up the opportunity to invest that money in other assets, such as a retirement account or a brokerage account [4]. Additionally, some student loans may have prepayment penalties or fees for early repayment. It’s essential to review your loan agreement and understand any potential consequences before making a decision.

In conclusion, whether you should pay off your student loans early depends on your individual financial situation and goals. It’s crucial to weigh the pros and cons of early repayment against your other financial priorities. If you’re unsure about what to do, consider consulting with a financial advisor or using online calculators to help make an informed decision.

Should I Pay Off My Student Loans Early? The Pros and Cons

(Content will follow)

Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

-

Q: What are the benefits of paying off my student loans early?

A: Paying off your student loans early can save you money on interest, give you more financial freedom, and help you achieve other goals, such as buying a home or starting a business. Additionally, it can also boost your credit score.

-

Q: How much can I actually save by paying off my student loans early?

A: The amount you can save depends on the interest rate and balance of your loan, as well as how much you pay each month. For example, if you have a $20,000 loan at 6% interest and you pay an extra $100 per month, you could save around $2,500 in interest over five years.

-

Q: Are there any downsides to paying off my student loans early?

A: One potential downside is that you may be giving up the opportunity to invest your money elsewhere, such as in a retirement account or a high-yield savings account. Additionally, if you have other debts with higher interest rates, it might make sense to prioritize those first.

-

Q: Should I use my tax refund to pay off my student loans?

A: It depends on your individual financial situation. If you have high-interest debt or a low emergency fund, using your tax refund to pay off your student loans might make sense. However, if you have other financial priorities, such as building up your savings or investing in retirement accounts, it might be better to use the money for those purposes.

-

Q: Can I negotiate a settlement with my lender?

A: It’s possible to negotiate a settlement with your lender, but it’s not always easy. You’ll need to make a strong case for why you’re having trouble making payments and offer a lump sum payment or a revised payment schedule that works for both of you. Keep in mind that this option is usually only available if you’re experiencing financial hardship.

In conclusion, whether you should pay off your student loans early depends on your individual financial situation and goals. It’s crucial to weigh the pros and cons of early repayment against your other financial priorities. If you’re unsure about what to do, consider consulting with a financial advisor or using online calculators to help make an informed decision.

Income-Based Repayment Plans for Student Loans: The Marriage Factor: Discover how student loan repayment plans can be affected by marriage and what you can do to navigate the complexities. Read more to learn how this can impact your financial future.

Biden’s Student Loan Solution: Expert Insights on His Approach to Higher Education: Get the inside scoop on President Biden’s plan to tackle student loans and what it means for your education and financial goals. Don’t miss this opportunity to stay ahead of the curve.

Golden 1 Personal Loan Credit Score Requirements: Are you considering a personal loan but unsure what credit score requirements are needed? Learn more about Golden 1’s credit score demands and how you can improve your chances of approval.