Sofi Personal Loan Application Process: Get Started Today!

Are you tired of living paycheck to paycheck, struggling to make ends meet? Do you dream of financial freedom, but don’t know where to start? You’re not alone. Millions of Americans are trapped in a cycle of debt, unable to break free from the shackles of high-interest rates and loan sharks.

But what if there was a way to take control of your finances, to borrow money at a lower rate than traditional lenders, and to build credit without sacrificing your financial stability? Enter Sofi, a game-changing personal loan application process that’s changing the face of lending.

What Makes Sofi Different?

Sofi is an innovative fintech company that offers a range of personal loans designed to help you achieve your financial goals. With a focus on transparency, flexibility, and affordability, Sofi’s loan application process is streamlined, efficient, and – most importantly – accessible.

In this article, we’ll delve into the ins and outs of the Sofi personal loan application process, exploring how you can get started today and start building the financial future you deserve. So why wait? Let’s get started!

Sofi Personal Loan Application Process: A Step-by-Step Guide

To apply for a Sofi personal loan, you’ll need to follow these steps:

- Check your credit score**: Your credit score plays a significant role in determining the interest rate and terms of your loan. You can check your credit score for free on websites like Credit Karma or Free Credit Score.

- Choose your loan amount**: Decide how much you need to borrow and what you’ll use the funds for. Keep in mind that Sofi offers loans ranging from $5,000 to $50,000.

- Determine your repayment term**: You can choose a repayment term that suits your financial situation, with options ranging from 2 to 7 years.

- Fill out the application form**: Visit Sofi’s website and fill out the online application form. You’ll need to provide personal and financial information, including your income, employment status, and credit history.

- Submit required documents**: Depending on your loan amount and credit score, you may need to provide additional documentation, such as proof of income or identification.

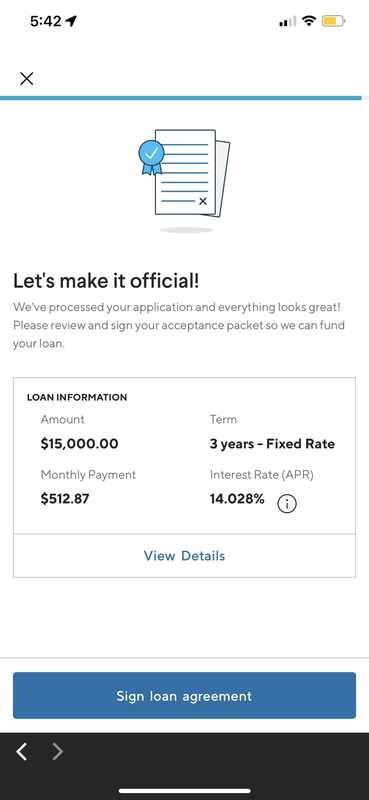

- Review and sign the loan agreement**: Once your application is approved, review the loan agreement carefully before signing and accepting the terms.

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

💬 Chat with a Loan Specialist NowFrequently Asked Questions

-

Q: What is the Sofi Personal Loan Application Process like?

A: The application process for a personal loan through our platform typically takes around 15-30 minutes to complete. You’ll need to provide some basic information about yourself and your financial situation, as well as details about the loan you’re applying for.

-

Q: Do I need to have a credit score to apply?

A: Yes, having a credit score is typically required in order to apply for a personal loan. Your credit score will be used to help determine your eligibility and the interest rate you’ll qualify for.

-

Q: What kind of documentation do I need to provide?

A: You may need to provide some additional documentation, such as proof of income, employment, or bank statements, in order to complete the application process. The specific documents required will depend on your individual circumstances and the type of loan you’re applying for.

-

Q: How long does it take to get approved?

A: Approval time can vary depending on the complexity of your application, the speed at which you provide required documentation, and the lending institution’s processing timeline. Typically, approval decisions are made within 24-48 hours after submitting a complete application.

-

Q: Can I apply for multiple loans?

A: No, it is generally not recommended to apply for multiple personal loans at the same time. This can negatively impact your credit score and make it more difficult to manage multiple loan payments.

Conclusion

The Sofi personal loan application process is a straightforward and efficient way to take control of your finances and achieve your goals. By following the step-by-step guide outlined above, you can navigate the application process with ease and get approved for a loan that meets your needs.

It’s essential to keep in mind that Sofi personal loans are designed to help you build credit without sacrificing financial stability. With a focus on transparency, flexibility, and affordability, Sofi’s loan application process is an attractive option for those looking to break free from the cycle of debt.

Remember to always review your credit score before applying, choose a repayment term that suits your financial situation, and fill out the application form accurately. By doing so, you’ll be well on your way to achieving financial freedom and building a brighter future.

Is it better to get a federal or private student loan: Wondering which type of student loan is right for you? This article provides valuable insights and tips to help you make an informed decision about whether to opt for federal or private loans. Read now to discover the pros and cons of each option!

Reviews of Great Lakes student loan servicing: What to expect: Are you curious about what it’s like to work with Great Lakes as your student loan servicer? This article delivers honest reviews and insider tips on what to anticipate when dealing with this popular servicer. Click to find out more!

Golden 1 personal loan credit score requirements: Want to know the secret to getting approved for a Golden 1 personal loan? This article reveals the exact credit score requirements and shares expert advice on how to boost your chances of approval. Read now to get started!