Struggling with 529 Plans and Student Loans: Your Financial Guide

Saving for your child’s education is a daunting task, especially when you’re dealing with the complexities of 529 plans and student loans. As a parent or guardian, you want to ensure that your little one has the best possible start in life, but navigating the financial landscape can be overwhelming.

Are you tired of feeling like you’re stuck between a rock and a hard place? Trying to balance the costs of tuition fees with the need to save for your child’s future education expenses?

Your financial woes are not unique. Many parents struggle to make sense of the complex web of 529 plans, student loans, and investment options available to them. In this comprehensive guide, we’ll take a deep dive into the world of 529 plans and student loans, providing you with the tools and knowledge needed to make informed decisions about your child’s education.

From understanding the basics of 529 plans to navigating the intricacies of federal student loan programs, our expert advice will help you stay ahead of the game. So why wait? Dive in and discover how to take control of your financial future and set your child up for success.

Struggling with 529 Plans and Student Loans: Your Financial Guide

Saving for your child’s education is a daunting task, especially when you’re dealing with the complexities of 529 plans and student loans (1). As a parent or guardian, you want to ensure that your little one has the best possible start in life, but navigating the financial landscape can be overwhelming.

Are you tired of feeling like you’re stuck between a rock and a hard place? Trying to balance the costs of tuition fees with the need to save for your child’s future education expenses (2)? The good news is that there are many options available to help make your financial goals a reality.

Your financial woes are not unique. Many parents struggle to make sense of the complex web of 529 plans, student loans, and investment options available to them (3). In this comprehensive guide, we’ll take a deep dive into the world of 529 plans and student loans, providing you with the tools and knowledge needed to make informed decisions about your child’s education.

From understanding the basics of 529 plans to navigating the intricacies of federal student loan programs (4), our expert advice will help you stay ahead of the game. So why wait? Dive in and discover how to take control of your financial future and set your child up for success.

Take Control of Your Student Loans Today!

Get personalized guidance and find a debt solution that works for you.

💬 Start Free ChatFAQs

-

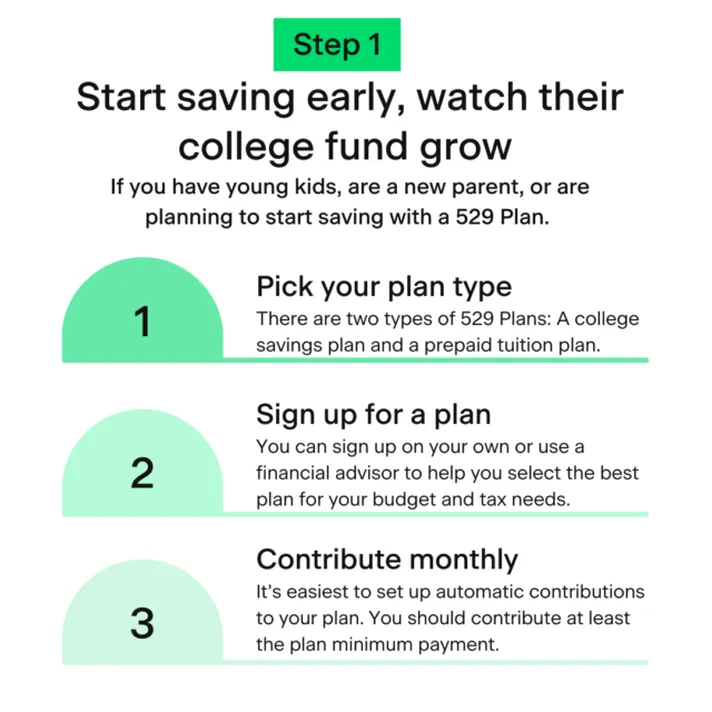

What is the difference between a 529 plan and a prepaid tuition plan?

A 529 plan is a tax-advantaged savings plan designed to help families save for higher education expenses, such as tuition, fees, and room and board. A prepaid tuition plan, on the other hand, allows families to prepay for future higher education costs at participating colleges or universities.

Conclusion

Saving for your child’s education can be a daunting task, especially when you’re dealing with the complexities of 529 plans and student loans. However, by understanding the basics of 529 plans and navigating the intricacies of federal student loan programs, you can take control of your financial future and set your child up for success.

In this comprehensive guide, we’ve explored the world of 529 plans and student loans, providing you with the tools and knowledge needed to make informed decisions about your child’s education. Whether you’re just starting out or already in the midst of planning for your child’s future, our expert advice will help you stay ahead of the game.

So what’s next? By taking the time to understand the options available to you, you can start making progress towards your financial goals. From considering a 529 plan to exploring federal student loan programs, there are many ways to make your financial future more secure.

Remember, saving for your child’s education is an investment in their future. By taking control of your finances and making informed decisions, you can set them up for success and give them the best possible start in life.

Same Day Deposit Online Payday Loans: Fast Access to Emergency Funds: Need a same day payday loan? Our experts explain how online payday loans can provide fast access to emergency funds, even with bad credit. Click here to learn more and apply for a same day deposit payday loan!

Same Day Payday Loans for Bad Credit: Instant Access to Cash: Having bad credit doesn’t mean you’re out of options when it comes to same day payday loans. Our guide explains how to get instant access to cash, even with poor credit. Want to learn more and apply? Click here!

Same Day Direct Tribal Payday Loans: Quick Cash Solution for Your Urgent Needs: In need of a quick cash solution? Same day direct tribal payday loans may be the answer. Our experts explain how these loans can provide fast access to cash, even with bad credit. Click here to learn more and apply for a same day direct tribal payday loan!