Streamlining Your Student Loan Debt: Top Banks for Consolidating Private and Federal Loans

Are you drowning in a sea of student loan payments? You’re not alone! The average student loan debt per borrower has surpassed $31,000, making it increasingly difficult to manage multiple loans with varying interest rates and payment schedules. That’s why consolidating your private and federal student loans can be a lifesaver – providing a single, lower monthly payment and potentially lower interest rate.

But where do you start? With numerous consolidation options available, it’s essential to choose the right bank for your unique financial situation. In this guide, we’ll explore the top banks for consolidating private and federal student loans, helping you navigate the process and achieve a more manageable debt load.

Streamlining Your Student Loan Debt: Top Banks for Consolidating Private and Federal Loans

Are you drowning in a sea of student loan payments? You’re not alone! The average student loan debt per borrower has surpassed $31,000 (Forbes), making it increasingly difficult to manage multiple loans with varying interest rates and payment schedules. That’s why consolidating your private and federal student loans can be a lifesaver – providing a single, lower monthly payment and potentially lower interest rate.

But where do you start? With numerous consolidation options available, it’s essential to choose the right bank for your unique financial situation. To make an informed decision, consider the following factors:

- Your current loan balance

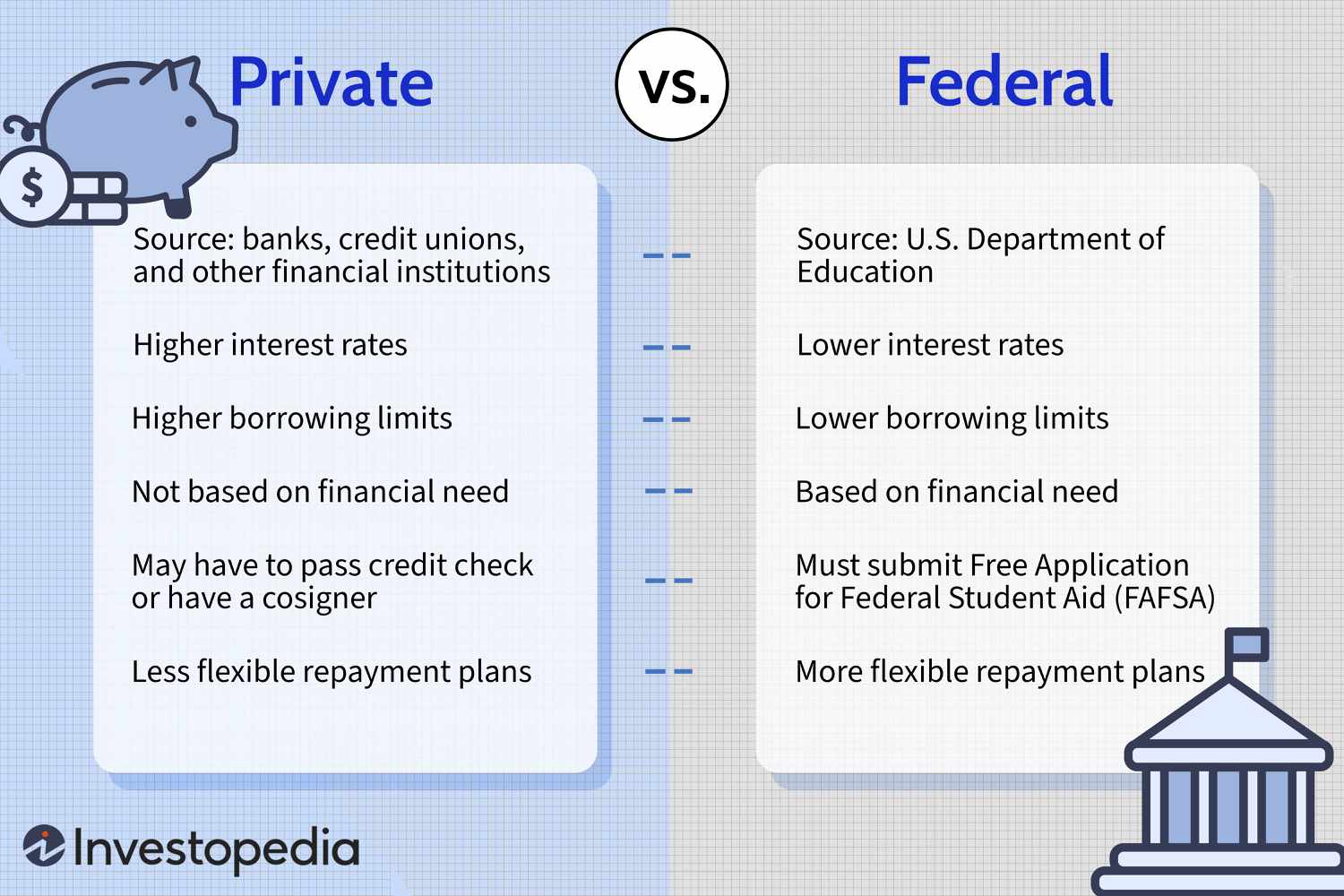

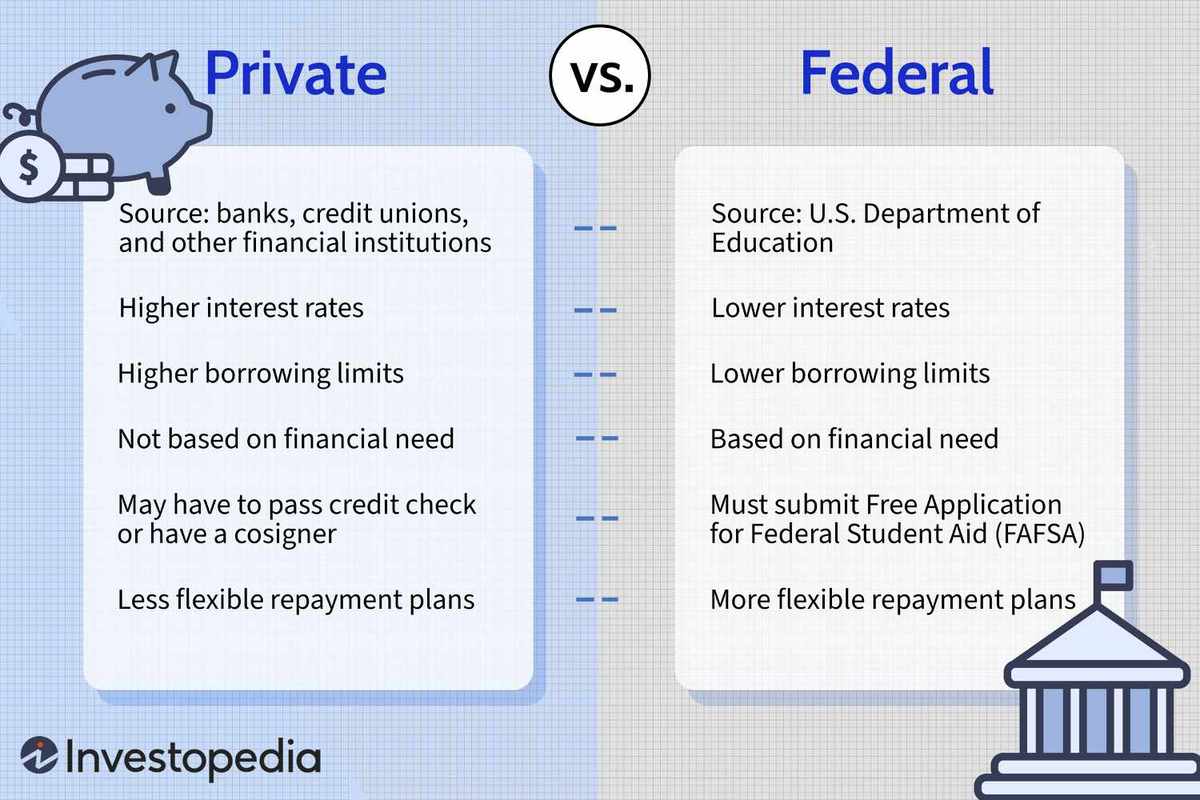

- The types of loans you have (federal, private, or a combination)

- Your credit score and history

- The interest rates on your existing loans

- The terms and conditions of each loan

To help you get started, here are some top banks for consolidating private and federal student loans:

1. Wells Fargo: Known for their variety of consolidation options, including fixed-rate and variable-rate loans.

2. Citizens Bank: Offers a range of consolidation loan options, including refinancing and combination loans.

3. Discover: Provides a simple online application process and competitive interest rates for consolidation loans.

4. Sallie Mae: Offers private student loan consolidation options with fixed-rate and variable-rate loans available.

5. PNC Bank: Provides a range of consolidation loan options, including refinancing and combination loans with competitive interest rates.

Get Started with Student Loan Consolidation

Take control of your student loan debt and enjoy lower payments, simplified billing, and more. Our top-rated banks for consolidating private and federal student loans can help.

💬 Start Free ChatFrequently Asked Questions

General Information

-

What is the purpose of consolidating private and federal student loans?

Consolidating private and federal student loans can simplify your payment process by combining multiple loans into one loan with a single interest rate, monthly payment, and due date. This can help you better manage your finances and reduce stress.

-

Who is eligible to consolidate their student loans?

You are generally eligible to consolidate your student loans if you have a minimum of $5,000 in outstanding federal education loan debt or multiple private student loans. However, the specific eligibility criteria may vary depending on the lender or program.

Conclusion

In today’s fast-paced world, managing multiple student loan payments can be overwhelming. By consolidating your private and federal student loans, you can simplify your financial situation and potentially lower your monthly payment. The top banks for consolidation, including Wells Fargo, Citizens Bank, Discover, Sallie Mae, and PNC Bank, offer a range of options to suit your unique financial needs.

When considering which bank to work with, it’s essential to evaluate the factors that impact your decision, such as your current loan balance, types of loans, credit score, interest rates, and loan terms. By taking the time to research and understand these factors, you can make an informed decision about which consolidation option is best for you.

Remember, consolidating your student loans can provide a sense of relief and help you achieve a more manageable debt load. With the right bank and understanding of the consolidation process, you can take control of your finances and start building a brighter financial future.

Same day payday loans online no credit check direct lenders available: Need a same-day loan with no credit checks? Our expert guide reveals the top direct lenders offering payday loans without credit checks. Learn how to get quick approval and overcome financial hurdles today!

Same day cash online payday loan – get quick approval: Running low on cash? Our same-day payday loan guide helps you navigate the application process and secure quick approval. Discover the best online lenders offering instant cash loans!

Online payday loans Sacramento: Living in Sacramento? We’ve got you covered! Our comprehensive guide to online payday loans in Sacramento provides a list of reliable lenders, tips for approval, and more. Get the help you need today!