Calculate Your Kotak Mahindra Bank Personal Loan EMI Today!

Are you considering taking a personal loan to fund your dream wedding, consolidate debt, or cover an unexpected expense? If so, calculating the right Equated Monthly Installment (EMI) is crucial to ensure that you don’t overburden yourself with debt. That’s why we’ve got you covered! With Kotak Mahindra Bank’s extensive network of branches and ATMs across the country, it’s no surprise that they’re one of India’s leading banks.

But before you apply for a personal loan from Kotak Mahindra Bank, have you given a thought to how much your monthly payments will be? Calculating EMI can seem daunting, but with our easy-to-use calculator, you can get an estimate in just a few clicks. By doing so, you’ll be able to plan your finances better and avoid any surprises down the line.

Calculate Your Personal Loan EMI Today!

When considering a personal loan to fund your goals or manage unexpected expenses, calculating the right Equated Monthly Installment (EMI) is crucial for budgeting and financial planning. Understanding how much you’ll need to pay each month can help you make informed decisions about your finances.

A personal loan can be used to consolidate debt, finance a wedding, cover an emergency, or achieve other goals. To determine the best loan option for your needs, it’s essential to calculate the EMI.

Learn more about EMI and how it works.By calculating your personal loan EMI in advance, you can:

- Budget effectively for monthly payments

- Avoid debt overload or financial stress

- Maintain a healthy credit score

Need a Personal Loan? Get Approved Fast!

Check Your Eligibility for a Low-Interest Loan – No Hidden Fees, No Hassle!

Calculate Your Kotak Mahindra Bank Personal Loan EMI Today!Frequently Asked Questions

-

Q: What is an EMI (Equated Monthly Installment) and how is it calculated?

A: An EMI is a fixed amount that you pay every month to repay your personal loan. The calculation of EMI takes into account the loan amount, interest rate, and repayment tenure. A lower EMI indicates a longer repayment period or a lower interest rate.

-

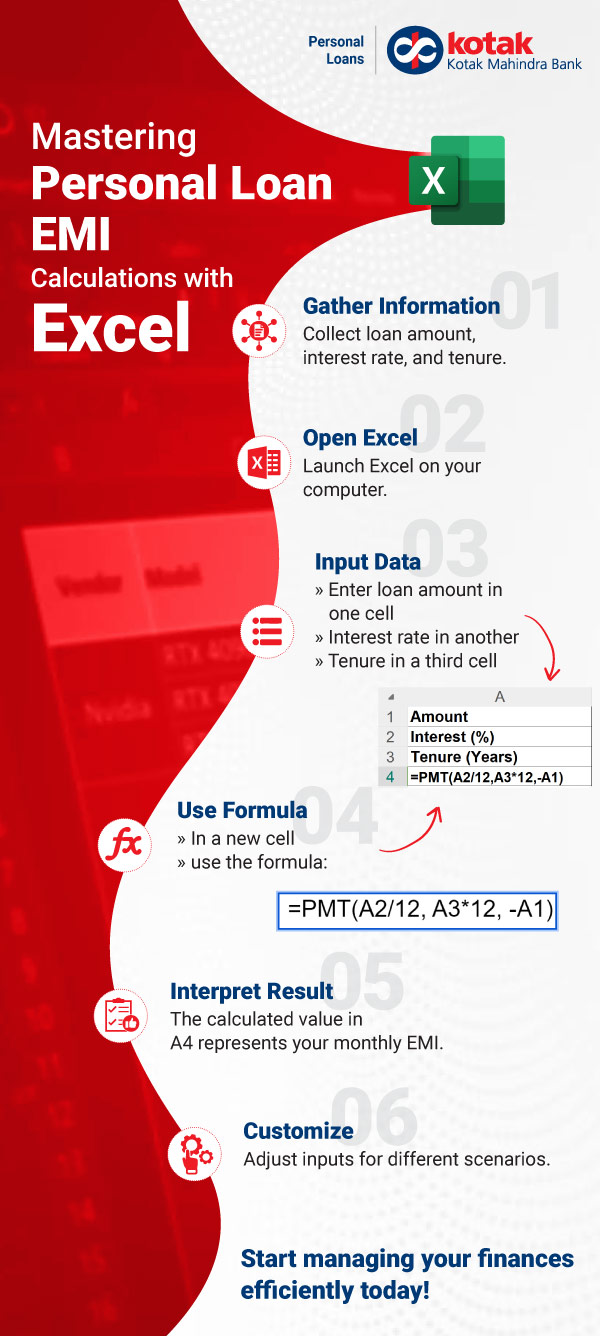

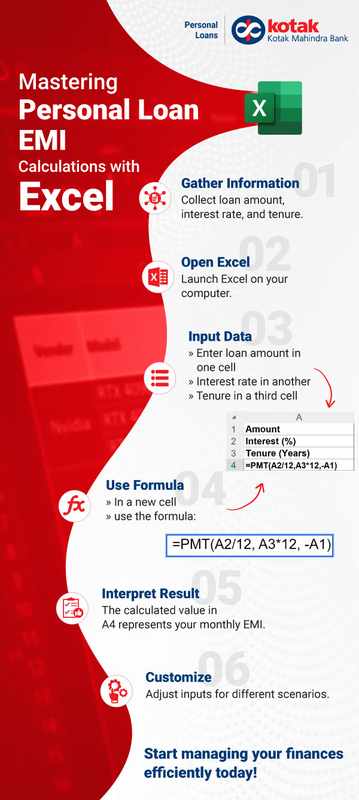

Q: How do I calculate my personal loan EMI?

A: You can use online calculators or financial tools to estimate your personal loan EMI. The formula to calculate EMI is: EMI = (Loan Amount x Rate of Interest) / ((1 + Rate of Interest)^Number of Payments). You can also consult a financial advisor for personalized advice.

-

Q: What factors affect my personal loan EMI?

A: Your personal loan EMI is influenced by several factors, including the loan amount, interest rate, repayment tenure, and credit score. A higher loan amount or a lower credit score may result in a higher EMI, while a longer repayment period can lead to a lower EMI.

-

Q: Can I prepay my personal loan?

A: Yes, you can prepay your personal loan in part or full. Prepayment may attract a prepayment charge, which varies depending on the lender and the remaining tenure of the loan. Consult your loan agreement to understand the terms and conditions.

-

Q: How does my credit score affect my personal loan EMI?

A: A good credit score can help you secure a lower interest rate, which in turn can reduce your EMI. A poor credit score may result in a higher interest rate and a higher EMI. Maintaining a healthy credit score is essential for managing your loan effectively.

Conclusion

Calculating your personal loan EMI can be a crucial step in planning your finances effectively. By understanding how much you’ll need to pay each month, you can make informed decisions about your financial goals and avoid debt overload or financial stress. Remember to consider factors such as the loan amount, interest rate, repayment tenure, and credit score when calculating your personal loan EMI.

With our easy-to-use calculator, you can get an estimate of your personal loan EMI in just a few clicks. This will help you plan your finances better and avoid any surprises down the line. So, why not start planning today? Calculate your personal loan EMI now and take control of your financial future.

Same day payday loans online no credit check direct lenders available: Need instant cash? Same day payday loans offer a quick fix for emergencies. Learn more about the best direct lenders that don’t require credit checks and get approved in minutes!

What is the best online payday loan company: Confused about which payday loan company to choose? We’ve got you covered! Discover the top-rated lenders that offer competitive rates, flexible terms, and fast approvals. Find out what sets them apart from the rest!

Get same day payday loan online in Texas: In a bind and need cash fast? Same day payday loans are available in Texas! Learn about the best lenders that offer instant approvals, flexible repayment terms, and no credit checks. Get the relief you need today!