Are You Wondering Where Your Student Loans Are?

If you’re one of the millions of students who’ve taken out student loans to fund your education, you might be wondering where those loans are – and more importantly, how to manage them effectively. With so many financial institutions and loan servicers involved in the process, it’s easy to get lost in a sea of paperwork and online portals. But don’t worry, we’re here to help! In this article, we’ll guide you through the steps to find out where your student loans are, what types of loans you might have, and how to keep track of them for the long haul.

Why Is It Important to Know Where Your Student Loans Are?

Knowing where your student loans are is crucial for several reasons. Firstly, it’s essential to understand what type of loan you have (federal or private) and who the lender is – this will help you determine your repayment options and interest rates. Secondly, keeping track of your loans can help you avoid late payments, missed deadlines, and potential penalties. Finally, knowing where your loans are can give you peace of mind and help you make informed decisions about your financial future.

Student Loans

How Do I Find Out Where My Student Loans Are?

If you’re one of the millions of students who’ve taken out student loans to fund your education, it’s essential to understand where those loans are and how to manage them effectively. With so many financial institutions and loan servicers involved in the process, it can be overwhelming. But don’t worry! Here’s a step-by-step guide to help you find out where your student loans are.

Step 1: Review Your Financial Aid Award Letter

Your college or university will typically provide you with a financial aid award letter that outlines the types and amounts of federal, state, and institutional financial aid you’re eligible for. This document should indicate whether you’ve received any federal student loans, such as Direct Subsidized or Unsubsidized Loans, Perkins Loans, or Federal Family Education Loans (FFEL).

What to Look For:

In your financial aid award letter, look for the following information:

- Type of loan: Federal, private, or institutional

- Loan amount and interest rate

- Lender or loan servicer’s name and contact information

Student Loans

Federal Student Aid National Student Loan Data System (NSLD)Struggling with Student Loan Payments?

See if You Qualify for Lower Payments & Better Rates – Speak with an Expert Now!

💬 Start Free ChatFrequently Asked Questions

-

Q: Where can I find my student loans?

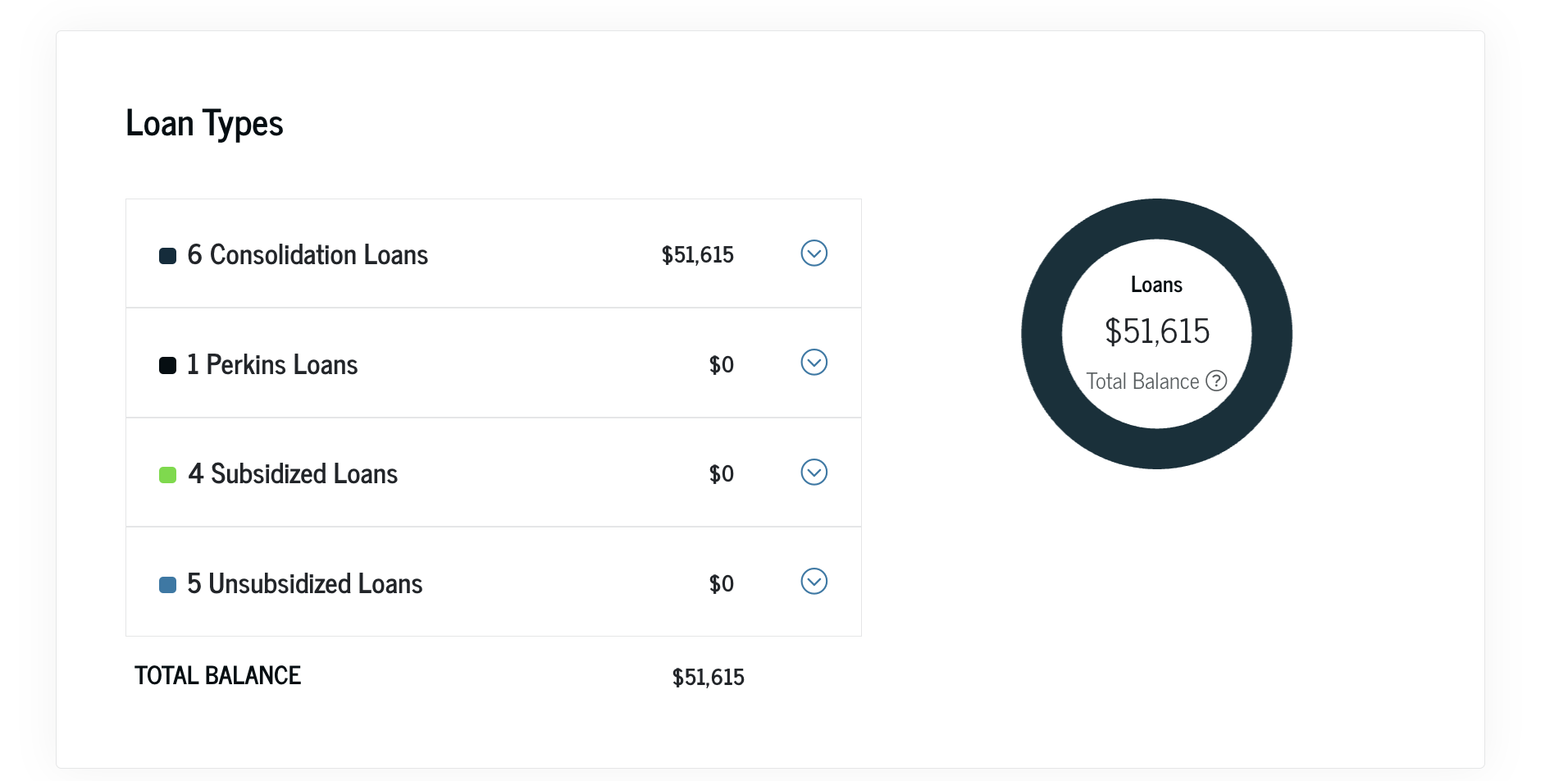

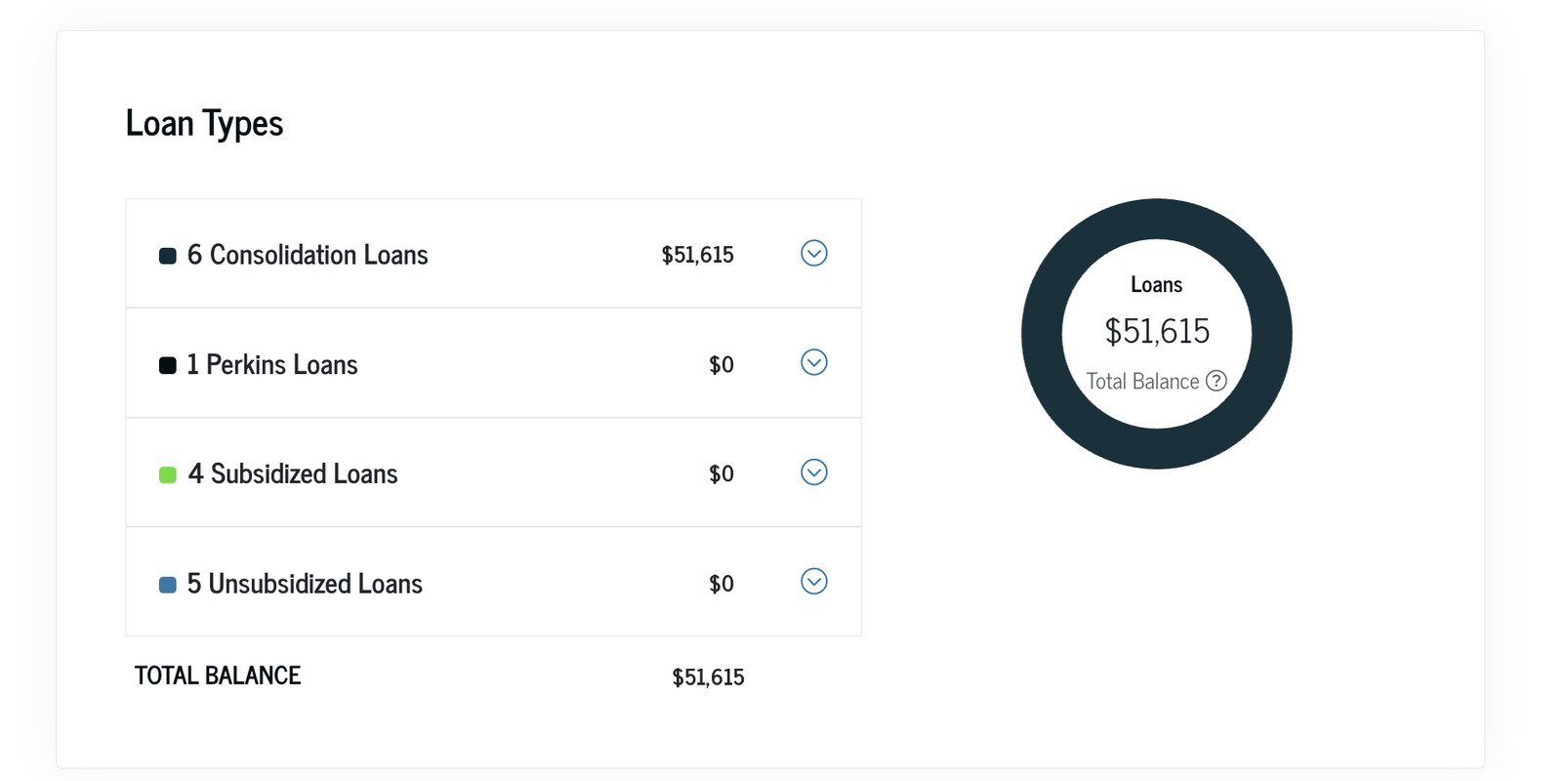

A: You can start by logging into the National Student Loan Data System (NSLDS) at nslds.ed.gov. This website will show you a summary of your federal student loans, including the type of loan, balance, and payment status.

-

Q: How do I know if my loans are private or federal?

A: To determine if your loans are private or federal, check your loan documents or contact your lender directly. If you’re unsure, you can also contact the Federal Student Aid Information Center at (800) 433-3243 or visit their website at studentaid.gov.

-

Q: Can I see my student loan history?

A: Yes, you can view your student loan history by logging into the NSLDS website or contacting your lender directly. They should be able to provide you with a breakdown of your loan payments, interest rates, and payment dates.

-

Q: How do I consolidate my federal student loans?

A: To consolidate your federal student loans, visit the Federal Student Aid website at studentaid.gov and follow the consolidation process. You can also contact the Federal Student Aid Information Center for more information.

Conclusion

In today’s complex financial landscape, it’s crucial to understand where your student loans are and how to manage them effectively. By following the steps outlined above, you can gain a better grasp of your loan situation and make informed decisions about your financial future.

Remember, knowing where your student loans are is just the first step. To truly take control of your debt, it’s essential to develop a solid plan for repayment, including setting realistic goals, prioritizing payments, and exploring options like consolidation or refinancing.

By being proactive and informed about your student loans, you can avoid costly mistakes, reduce financial stress, and achieve long-term financial stability. So take the first step today and start navigating your student loan landscape with confidence!

Same day funding California payday loans – no credit check direct lender: Get immediate financial assistance without the hassle of lengthy approval processes. Learn how to secure same-day funding for your emergency needs in California.

Guaranteed approval best bad credit payday loans: Don’t let a poor credit history hold you back from getting the financial help you need. Discover the top-rated bad credit payday loan providers that offer guaranteed approval and flexible repayment terms.

Same day payday loans quick access to financial assistance: Are you facing an unexpected expense or emergency? Same day payday loans provide a quick and easy solution for accessing the funds you need. Learn more about this convenient financing option.